Working Age Around the World: Where Can Teens Start and Seniors Keep Going?

Working Age Around the World: Where Can Teens Start and Seniors Keep Going? (Including Texas!). Across the globe, demographics are shifting. Populations are aging, and so are ideas about retirement age. While some countries see seniors thriving in the workforce well past 65, others have younger generations eager to start earning their stripes. Let’s explore the fascinating disparities in legal working ages and delve into the case of Texas!

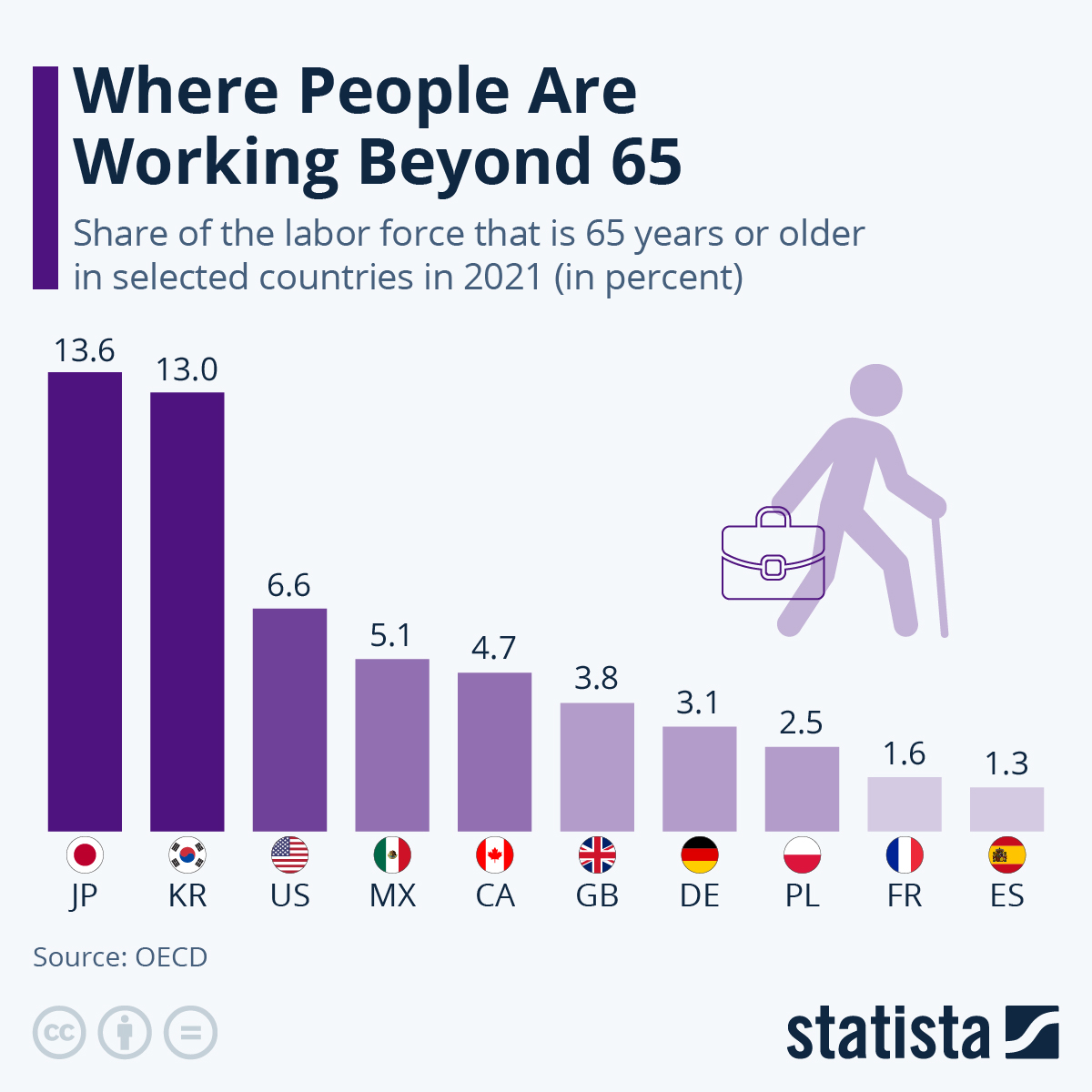

Beyond 65: Where Work Ethic Knows No Age Limit

The Organization for Economic Cooperation and Development (OECD) paints a surprising picture. While Europe witnesses lower senior labor participation (1.3% in Spain!), countries like Japan and Korea boast impressive numbers (13-14%!). Despite raised retirement ages in Europe, cultural and economic factors seem to influence seniors’ decisions to stay active in the workforce.

The American Dream and Working Longer(Working Age):

The United States holds a unique position. With a minimum retirement age similar to Europe’s, the U.S. sees a higher 6.6% senior labor force participation. This statistic speaks volumes about the American work ethic and potential economic pressures like individual pension systems and limited public benefits.

Legal age to work in Texas: When Can You Start Earning?

Now, let’s zoom in on Texas. The Lone Star State generally allows 14-year-olds to enter the workforce, with specific exceptions for agriculture and entertainment. However, stricter limitations apply to working hours and types of jobs for minors under 16. Remember, child labor laws exist to protect young people, so ensure compliance if you’re considering hiring a minor.

Exploring Further: A World of Diverse Working Ages

You will find more infographics at Statista

You will find more infographics at Statista

This post has merely scratched the surface of global working age disparities. From countries where teenagers contribute to family income to nations encouraging extended senior careers, the world offers a rich tapestry of approaches. By understanding these differences, we can foster informed discussions about work, retirement, and the evolving needs of our societies.

Factors Contributing to the Disparity:

- Cultural Attitudes: In Japan and Korea, there’s a strong cultural emphasis on work ethic and societal respect for elders. This, coupled with robust senior support systems, encourages continued work past retirement age. In contrast, some European countries may have stronger social safety nets that allow for earlier retirement without significant financial hardship.

- Pension Systems: The US and Japan heavily rely on individual pension accounts, potentially pushing individuals to work longer to secure adequate retirement income. In contrast, European countries with more generous public pension systems might enable earlier retirement.

- Healthcare Access: Affordable and accessible healthcare plays a crucial role. If seniors can maintain good health and manage chronic conditions, they’re more likely to remain in the workforce longer.

- Labor Market Flexibility: Countries with flexible work arrangements like part-time, remote, or freelance opportunities might see higher senior participation as these cater to specific needs and limitations.

- Job Opportunities: Availability of age-friendly jobs that match skills and experience also influences how long seniors stay in the workforce.

Additional Insights:

- The US data might not capture the full picture. Many older Americans might work in informal or “gig” economy jobs, which may not be reflected in official statistics.

- The disparity isn’t static. As demographics and socioeconomic realities shift, participation rates could change across countries.

- Policy reforms can play a role. Governments can incentivize continued work through targeted benefits, flexible work options, and addressing age discrimination.

The Looming Retirement Crisis: How Aging Populations are Straining Systems Worldwide

You will find more infographics at Statista

You will find more infographics at Statista

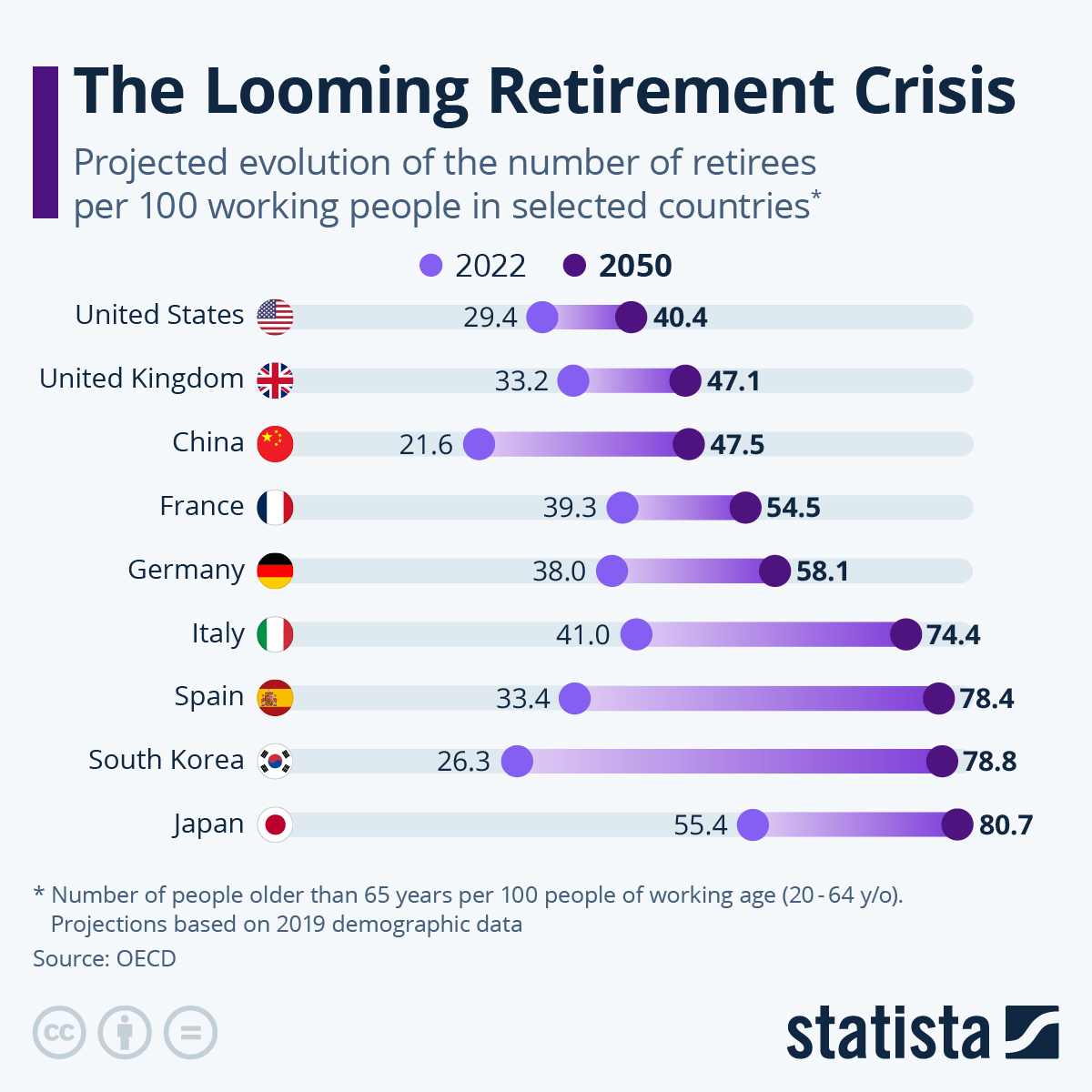

The world is getting older, and that’s presenting a major challenge for many countries. Falling birth rates combined with rising life expectancies are creating a perfect storm, with fewer working-age individuals supporting a growing elderly population. This “looming retirement crisis” threatens to overwhelm labor markets, healthcare systems, and pension systems, demanding urgent action and innovative solutions.

The Numbers Tell the Story (Working Age):

The OECD data paints a stark picture. Countries like Japan and Italy already face a significant burden, with over 40 retirees for every 100 workers. These numbers are projected to explode, reaching 81 and 74 respectively by 2050. This imbalance means fewer people contributing to essential taxes and social security programs, while the demand for healthcare and pension payouts soars.

The Ripple Effect:

The strain won’t be contained to specific sectors. Let’s explore the domino effect:

- Labor Markets: Fewer young workers entering the workforce could lead to labor shortages, impacting economic growth and potentially driving up wages. However, older workers staying in the workforce longer could mitigate this issue, requiring skills training and age-friendly work environments.

- Healthcare Systems: An aging population often translates to increased healthcare needs. This strains resources, potentially leading to longer wait times, reduced access to services, and rising healthcare costs. Investing in preventative care and age-appropriate healthcare models can help alleviate this pressure.

- Pension Systems: With more retirees and fewer contributors, traditional pay-as-you-go pension systems risk becoming unsustainable. This could lead to reduced benefits, increased contribution rates, or even system collapse. Exploring alternative funding models and encouraging personal retirement savings are crucial strategies.

Beyond the Immediate Crisis(Working Age):

While the challenges are significant, they also present opportunities for innovation and positive change. Some possibilities include:

- Promoting healthy aging: By investing in preventative healthcare and promoting healthy lifestyles, we can extend productive lifespans and reduce healthcare burdens.

- Supporting lifelong learning: Equipping individuals with the skills needed to adapt to changing job markets throughout their lives is essential.

- Rethinking retirement: Flexible work arrangements and phased retirement models can allow individuals to contribute longer while enjoying a gradual transition to full retirement.

- Encouraging immigration: Welcoming skilled immigrants can help address labor shortages and contribute to economic growth.

No Easy Answers:

Addressing the retirement crisis requires a multifaceted approach. Each country’s unique demographic situation and existing systems demand tailored solutions. However, by acknowledging the challenges, fostering open dialogue, and implementing proactive measures, we can navigate this demographic shift and build a more sustainable future for all generations.

Minimum Wage Around the World: Lowest and Highest

KratomKavaBar – PreWorkout kratom tea, kratom coffee, kratom capsules