Binance Sued by CTFC, Bitcoin Ethereum big plunge

Binance Sued by CTFC, Bitcoin Ethereum big plunge. The lawsuit filed by the regulator claims that Binance breached derivative trading regulations in the United States.

Binance, which is the top cryptocurrency exchange in terms of trading volume, along with its CEO Changpeng Zhao, faced a lawsuit on Monday from the Commodity Futures Trading Commission (CFTC). The regulator claimed that Zhao and his company violated rules related to trading and derivatives, as per a lawsuit filed by the CFTC in a federal court in Chicago.

According to CoinGecko, the news caused a decline in the value of the two biggest cryptocurrencies in terms of market capitalization, Bitcoin and Ethereum. Bitcoin dropped 3.3% to $26,800, while Ethereum fell 2.9% and traded at less than $1,700 over the past hour.

Binance CEO Changpeng Zhao responded to the CFTC’s lawsuit announcement by tweeting the number “4,” which refers to a previous tweet he made in January about ignoring false information and attacks. The lawsuit alleges that Binance violated derivatives trading rules in the U.S. by operating a facility for trading digital asset derivatives since at least July 2019, allowing U.S. residents to trade futures, swaps, and options on cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The lawsuit also claims that despite Binance’s claims to block or restrict access to its platform for U.S. customers, the company made calculated efforts to expand its presence in the country.

According to the lawsuit, Binance and its CEO, Zhao, were aware that they needed to register Binance with the CFTC after attracting customers in the U.S., but they decided to ignore these obligations and undermine the company’s ineffective compliance program.

As to the lawsuit, Binance, along with its officers, employees, and agents, assisted users in concealing their location by using a virtual private network (VPN) as one of the ways to undermine its compliance program. As per CNBC’s report last week, the exchange allegedly helped people in China bypass restrictions to access its platform. The lawsuit also alleges that Binance’s non-disclosure of the location of its executive offices is a reflection of its attempt to avoid regulation. The exchange is accused of non-compliance with laws that aim to prevent money laundering and terrorist financing.

According to a lawsuit filed by the CFTC in a Chicago federal court, Binance, along with its CEO Changpeng Zhao, violated trading and derivatives rules. Binance is the leading cryptocurrency exchange by trading volume. The regulator’s lawsuit alleges that the exchange and its CEO violated derivative trading rules in the U.S. The lawsuit claims that Binance operated a facility for trading digital asset derivatives in the U.S. since at least July 2019, allowing residents to trade futures, swaps, and options on cryptocurrencies including Bitcoin, Ethereum, and Litecoin. Binance made attempts to grow its footprint in the U.S. despite claims that the exchange would prevent U.S. residents from accessing its platform, the lawsuit claims.

The lawsuit alleges that Binance, Zhao, and other employees at the exchange knew they were required to register Binance with the CFTC after soliciting customers in the U.S. but chose to ignore those requirements. The exchange also undermined its compliance program by having its officers, employees, and agents assist users in using a virtual private network (VPN) to obscure their location, according to the lawsuit.

The CFTC seeks to compel Binance to repay allegedly ill-gotten gains that stem from the misconduct it is accused of, pay civil penalties, and accept bans on trading as well as its ability to register within the U.S. The lawsuit includes messages sent via the encrypted messaging app Signal that were collected from Zhao’s telephone. It added that Zhao instructed Binance representatives to use Signal to communicate with customers based in the U.S.

Source: Decrypt

Case against Binance – first significant legal action taken against a cryptocurrency company since 2021

This is the first major legal action taken by federal commodity regulators against a cryptocurrency company in the US since BitMEX was fined $100 million in 2021 for running an illegal foreign derivatives trading platform.

What is a crypto derivative?

Acquiring crypto derivatives is distinct from purchasing cryptocurrencies themselves. Rather, purchasing a derivative enables an investor to place a leveraged wager on the potential rise or fall of a cryptocurrency’s price, similar to any other commodity. This practice is subject to heavy regulation by the CTFC in the US and completely illegal in certain nations, such as the UK. Regulators regard these trades as too susceptible to manipulation to be appropriate for retail investors. Buying crypto derivatives in the US requires a host of protections, such as safeguards for investors and strict protocols to mitigate money-laundering risks.

According to a 2021 Wall Street Journal article, American investors regularly used VPNs to access foreign cryptocurrency markets in defiance of CTFC rules. “Binance has instructed US customers to circumvent such controls by using VPNs to obscure their true location,” the CFTC’s lawsuit claims. “The use of VPNs by customers to access and trade on the Binance platform has been an open secret, and Binance has consistently been aware of and encouraged the use of VPNs by US customers.”

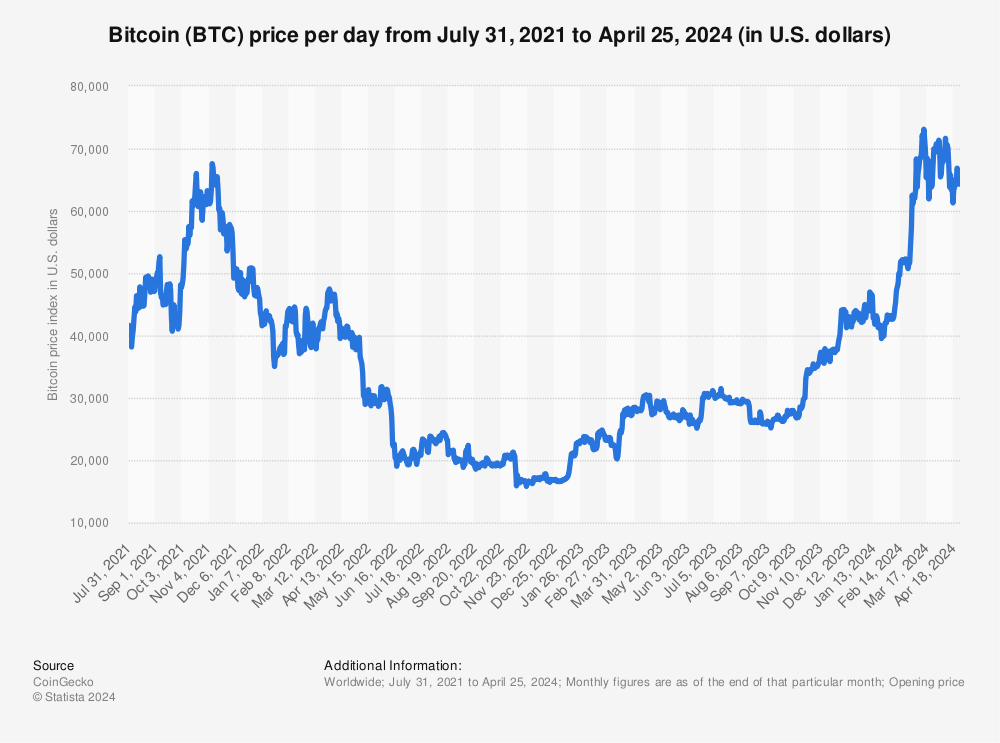

Bitcoin has experienced a small recovery after a difficult year in 2022

Find more statistics at Statista

Binance Reacts to CFTC Lawsuit

Binance has responded to the recent regulatory lawsuit by saying that it plans to continue safeguarding its users while working with regulators to establish a transparent regulatory framework. A Binance spokesperson expressed disappointment with the lawsuit, saying that the company had been working with the CFTC for over two years. Nonetheless, Binance intends to maintain its cooperation with regulators in the U.S. and globally.

According to Binance, the company has invested heavily in ensuring that US users are not active on its platform. Over the past two years, it has increased its compliance team from 100 people to around 750 people who focus on compliance. To strengthen its compliance program, Binance has hired former law enforcement and regulatory agency members and spent over $80 million on transaction monitoring, market surveillance, and investigative tools. Binance claims to have implemented a “robust ‘three lines of defense’ approach” to manage both risk and compliance. The approach includes mandatory KYC, blocking US IP addresses and cellular providers to ban US residents, and preventing deposits and withdrawals from US banks. The company stated that it intends to continue working with regulators in the US and worldwide to create a transparent regulatory framework. Some experts have speculated that the CFTC has a strong chance of succeeding in toppling the Binance empire with this lawsuit.

How do you select a secure Crypto Trading Platform

Everything you need to know about Crypto

Know it all – cryptocurrency storage