How to Develop an ESG Strategy

How to develop an ESG strategy.

Developing an Effective ESG Strategy: A Blueprint for Sustainable Success

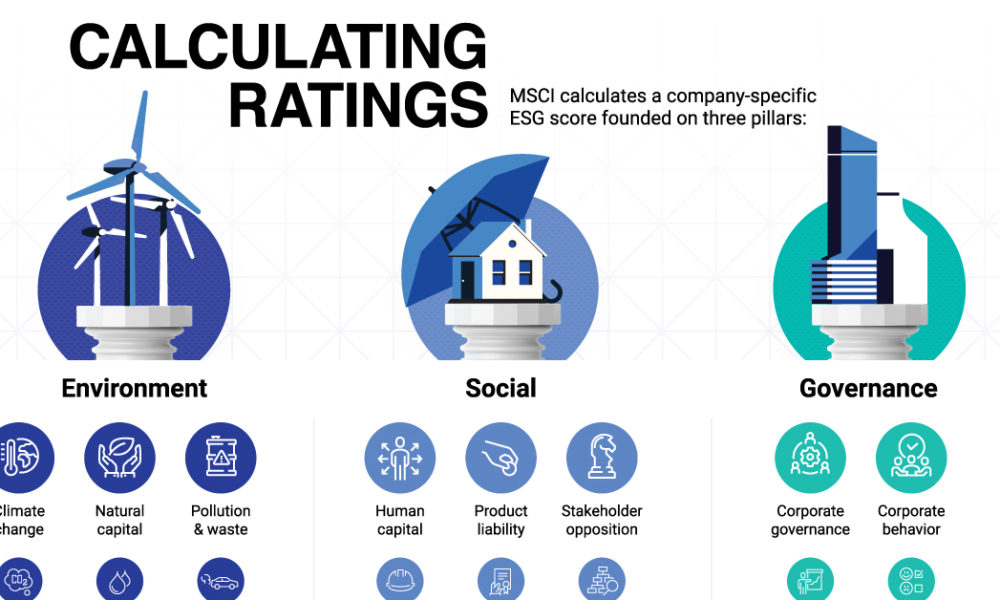

In today’s business landscape, developing an Environmental, Social, and Governance (ESG) strategy has become paramount for companies seeking long-term success and positive impact. In this blog post, we provide a comprehensive guide on how to develop an effective ESG strategy. By following this blueprint, you can align your business with sustainability principles, enhance stakeholder relationships, and drive meaningful change. Let’s dive in

How to develop an ESG strategy – Assessing Current State

To develop an effective ESG strategy, it is essential to begin with a comprehensive assessment of your organization’s current ESG performance. This evaluation will provide a clear understanding of where you stand in terms of environmental impacts, social practices, and governance structures. Here’s how you can conduct this assessment and identify areas for improvement

Environmental Impacts

Evaluate your organization’s environmental footprint by assessing factors such as energy consumption, greenhouse gas emissions, water usage, waste generation, and resource consumption. Consider conducting a thorough environmental audit to identify areas of inefficiency and opportunities for improvement. This assessment will help you understand the environmental risks and impacts associated with your operations and guide you in setting targets for reducing your ecological footprint.

Social Practices

Examine your organization’s social practices and their impact on employees, customers, local communities, and other stakeholders. Assess factors such as employee welfare, diversity and inclusion, labor rights, human rights, community engagement, and product or service impacts on society. Gather feedback from employees, conduct surveys, and engage with relevant stakeholders to understand their perceptions and expectations. This evaluation will help identify areas where your organization excels and areas where improvements are needed to align with ESG principles.

Governance Structures

Evaluate your organization’s governance structures and practices to ensure they align with ESG principles. Assess the effectiveness of your board of directors in providing oversight and strategic guidance. Review policies and procedures related to ethics, transparency, anti-corruption measures, executive compensation, and risk management. Identify any gaps in governance practices that need to be addressed to enhance accountability, transparency, and ethical conduct.

Identify Strengths and Weaknesses

Based on the assessment of your organization’s ESG performance, identify its strengths and weaknesses. Recognize areas where your organization is already excelling and can serve as a foundation for further improvement. These strengths can be leveraged to build upon your ESG initiatives. Simultaneously, identify weaknesses and gaps that require attention and improvement. These areas will be the focus of your ESG strategy development efforts.

How to develop an ESG strategy – Understand Key Areas for Improvement

Based on the assessment, prioritize key areas for improvement within your organization’s ESG performance. Consider the relevance and materiality of these areas to your industry, stakeholders, and long-term sustainability goals. This understanding will help you identify the most critical ESG issues that need to be addressed and guide the development of specific targets, actions, and initiatives.

By conducting a thorough assessment of your organization’s current ESG performance, you gain a comprehensive understanding of your strengths, weaknesses, and areas for improvement. This analysis serves as the foundation for developing a robust and tailored ESG strategy that aligns with your organization’s values, stakeholder expectations, and sustainability objectives. It enables you to set realistic goals, implement targeted actions, and monitor progress effectively on your journey toward sustainable success.

:max_bytes(150000):strip_icc()/ESG-final-fc9c8799d2d34234a895cbab621c21ad.png)

How to develop an ESG strategy –Define ESG Priorities

Once you have conducted a thorough assessment of your organization’s current ESG performance, the next step in developing an effective ESG strategy is to define your ESG priorities. This involves identifying the key areas where your organization can make the most significant impact and aligning them with your business values and industry context. Here’s how you can approach this process:

Review Assessment Findings

Refer back to the findings from your assessment, including the strengths, weaknesses, and areas for improvement. Take into account the quantitative and qualitative data collected during the assessment, as well as the feedback from stakeholders. This will provide valuable insights into the ESG issues that are most relevant and critical for your organization.

Consider Materiality

Assess the materiality of the identified ESG issues. Materiality refers to the significance of an issue based on its potential impact on the organization and the expectations of stakeholders. Consider the economic, environmental, and social impacts of each issue, along with their relevance to your industry and stakeholder concerns. Prioritize the ESG issues that have the greatest potential to affect your organization’s long-term success and sustainability.

Align with Business Values

Evaluate how each ESG issue aligns with your organization’s core values, mission, and purpose. Choose priorities that resonate with your organizational culture and are consistent with your overall business strategy. This alignment ensures that your ESG efforts are integrated into your business model and reinforce your organization’s values and purpose.

Address Stakeholder Concerns

Engage with your stakeholders to understand their expectations, concerns, and priorities regarding ESG. Consider the perspectives of customers, employees, investors, local communities, supply chain partners, and other relevant stakeholders. Take into account the evolving societal expectations and regulatory requirements. By addressing the concerns and interests of your stakeholders, you demonstrate your commitment to responsible and sustainable business practices.

How to develop an ESG strategy – Focus on Impact

Identify the ESG priorities where your organization can make the most significant impact. Consider the potential positive outcomes and benefits that can be achieved through your actions. Focus on areas where your organization has the capabilities, resources, and influence to effect meaningful change. This targeted approach ensures that your ESG strategy is practical, measurable, and impactful.

Examples of ESG Priorities

ESG priorities can vary depending on your organization’s specific context and industry. Common ESG priorities include:

- Environmental: Reducing carbon emissions, adopting renewable energy sources, conserving water, managing waste, and protecting biodiversity.

- Social: Promoting diversity, equity, and inclusion, ensuring fair labor practices, enhancing employee health and safety, fostering community engagement, and supporting social initiatives.

- Governance: Strengthening ethical business practices, enhancing board independence and accountability, ensuring effective risk management, and improving transparency in financial reporting.

By defining your ESG priorities, you establish a clear focus for your organization’s sustainability efforts. These priorities serve as guiding principles for developing specific goals, strategies, and action plans. They enable you to concentrate your resources and efforts on the areas where you can drive meaningful change, maximize positive impacts, and address the expectations of your stakeholders.

![SDG through the lens of ESG [18].](https://www.researchgate.net/profile/Henrik-Saetra/publication/353555440/figure/fig2/AS:1050904836980737@1627566646843/SDG-through-the-lens-of-ESG-18.png)

How to develop an ESG strategy –Set Measurable Goals

Once you have identified your ESG priorities, the next step in developing an effective ESG strategy is to set measurable goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). By setting clear and quantifiable targets, you can track progress, evaluate performance, and demonstrate your organization’s commitment to sustainability. Here’s how you can approach setting measurable goals

Specificity

Ensure that your goals are specific and clearly defined. Avoid vague or generic statements. Instead, articulate precisely what you aim to achieve. For example, instead of setting a goal to “reduce carbon emissions,” specify the target percentage reduction you want to achieve within a specific timeframe.

Measurability

Establish metrics and indicators that allow you to measure progress toward your goals. Choose quantifiable measurements that can be tracked over time. For instance, if your goal is to increase gender diversity within leadership positions, specify the percentage increase you aim to achieve by a specific date.

Attainability

Set goals that are challenging yet realistic and attainable. Consider your organization’s capacity, available resources, and capabilities. While it’s important to be ambitious, setting unattainable goals may lead to frustration and lack of motivation. Strike a balance between stretching your organization’s capabilities and setting achievable targets.

Relevance

Ensure that your goals are relevant to your organization’s ESG priorities and align with your business context. Link your goals to the specific ESG issues you have identified as important. By aligning your goals with your ESG priorities, you reinforce their importance and demonstrate a focused commitment to sustainability.

Time-bound

Assign specific timeframes to your goals to create a sense of urgency and accountability. Set deadlines for achieving your targets, whether it’s within a year, three years, or a longer timeframe. Time-bound goals help track progress, create a sense of momentum, and allow for periodic evaluation and adjustment of strategies.

How to develop an ESG strategy – Regular Evaluation and Adjustments

Regularly evaluate your progress toward your goals and make adjustments as necessary. Monitor your performance against the set metrics and indicators. If you are falling behind, analyze the reasons and identify corrective actions. Likewise, if you are surpassing your goals, consider raising the bar to maintain a continuous improvement mindset.

Examples of Measurable ESG Goals: Here are some examples of measurable ESG goals aligned with different priorities:

- Environmental: Achieve a 20% reduction in water consumption by 2025, implement renewable energy sources to cover 50% of total energy consumption within three years, or attain zero waste to landfill certification within two years.

- Social: Increase the representation of underrepresented groups in senior leadership positions by 30% by 2023, achieve a 15% reduction in employee turnover rate within one year, or implement a community outreach program that positively impacts the lives of 1,000 people by 2024.

- Governance: Establish a board diversity policy and achieve a minimum of 30% representation of women on the board within three years, implement a robust whistleblower protection program by the end of the year, or conduct an independent external audit of ethical practices annually.

By setting measurable goals, you provide clarity and direction to your organization’s ESG efforts. These goals serve as milestones for progress, help allocate resources effectively, and allow for benchmarking and comparison against industry peers. They demonstrate your organization’s commitment to sustainability, drive accountability, and provide a roadmap for achieving meaningful ESG outcomes.

How to develop an ESG strategy – Engage Stakeholders

Engaging with stakeholders is a crucial step in developing an effective ESG strategy. By involving a wide range of stakeholders, including employees, investors, customers, suppliers, local communities, and advocacy groups, you can gain valuable insights, understand expectations, and incorporate diverse perspectives into your strategy. This inclusive approach enhances the credibility and effectiveness of your ESG initiatives. Here’s how you can effectively engage stakeholders

Identify Key Stakeholders

Begin by identifying the key stakeholders relevant to your organization and its ESG efforts. This may include employees, investors, customers, suppliers, local communities, industry associations, NGOs, and regulatory bodies. Consider both internal and external stakeholders who have a vested interest in your organization’s operations, impacts, and long-term success.

Develop Communication Channels

Establish effective communication channels to engage with stakeholders. This may include town hall meetings, focus groups, surveys, interviews, online forums, social media platforms, and dedicated feedback mechanisms. Tailor your communication channels to suit the preferences and accessibility of different stakeholder groups.

Listen and Understand

Create opportunities to actively listen to stakeholders and understand their perspectives, concerns, and expectations regarding ESG. Provide platforms where stakeholders can express their opinions, share experiences, and provide feedback. Actively seek their input on specific ESG topics, challenges, and potential solutions. Demonstrating a genuine interest in their views builds trust and strengthens the collaborative approach.

Collaborate and Co-create

Engage stakeholders in a collaborative process to co-create your ESG strategy. Seek their expertise, ideas, and suggestions on setting goals, developing initiatives, and establishing performance indicators. Encourage meaningful dialogue, foster an inclusive environment, and value the diverse perspectives that stakeholders bring to the table. Collaboration enhances the legitimacy and acceptance of your ESG strategy.

Transparently Communicate

Ensure transparent and timely communication of your ESG strategy, progress, and outcomes to stakeholders. Share information on the decision-making process, rationale behind goal-setting, and the actions being taken to address ESG issues. Regularly provide updates and reports on key initiatives, milestones, and performance against targets. Transparent communication builds credibility, trust, and accountability.

Tailor Engagement Approaches

Recognize that different stakeholder groups may have distinct needs and interests. Tailor your engagement approaches to cater to the specific requirements of each group. For example, employees may benefit from internal workshops or training sessions, while investors may value comprehensive ESG reports and investor briefings. Customizing engagement approaches ensures meaningful and relevant interactions with stakeholders.

Long-term Relationship Building

View stakeholder engagement as an ongoing process and a long-term relationship-building effort. Nurture relationships with stakeholders beyond the development of your ESG strategy. Continuously seek their input, update them on progress, and involve them in ongoing dialogue. Regularly review and adapt your engagement strategies based on evolving stakeholder expectations and emerging issues.

By actively engaging stakeholders, you tap into a wealth of knowledge, perspectives, and experiences that can shape your ESG strategy and ensure its relevance and effectiveness. Collaboration with stakeholders builds trust, enhances reputation, and fosters a shared sense of ownership in your sustainability journey. Ultimately, engaging stakeholders empowers them to become advocates for your organization’s ESG initiatives and helps drive positive change at a broader level.

How to develop an ESG strategy – Implement Governance Structures

Implementing robust governance structures is a critical component of developing an effective ESG strategy. These structures provide the necessary framework to support and drive sustainability efforts within your organization. By appointing responsible leaders, embedding ESG considerations into decision-making processes, and fostering a culture of transparency, accountability, and ethical behavior, you can ensure the successful implementation of your ESG strategy. Here’s how you can establish strong governance structures

Leadership Commitment

Ensure that senior leaders within your organization demonstrate a strong commitment to sustainability and ESG. Appoint leaders who understand the importance of ESG and are passionate about driving positive change. These leaders should champion sustainability initiatives, communicate the strategic importance of ESG, and set the tone from the top.

Responsible Governance Committee

Establish a dedicated governance committee or integrate ESG responsibilities into existing governance structures. This committee should be responsible for overseeing the development and implementation of your ESG strategy. Its role is to provide guidance, monitor progress, and ensure accountability. The committee should comprise individuals with relevant expertise, diverse perspectives, and a clear understanding of ESG issues.

Embedding ESG into Decision-Making

Integrate ESG considerations into your organization’s decision-making processes. Ensure that ESG factors are systematically assessed and incorporated into strategic planning, risk management, investment decisions, and day-to-day operations. This integration ensures that sustainability is not viewed as an isolated initiative but as a core consideration in all business activities.

Transparency and Reporting

Promote a culture of transparency and accountability by establishing clear reporting mechanisms for ESG performance. Develop key performance indicators (KPIs) and metrics that align with your ESG priorities and track progress over time. Regularly report on ESG performance to stakeholders, including investors, employees, customers, and communities. Transparent reporting enhances credibility and allows for external verification of your organization’s ESG efforts.

Ethical Behavior and Compliance

Embed ethical behavior and compliance with relevant laws, regulations, and industry standards into your organizational culture. Establish a code of conduct that explicitly addresses ESG principles and expectations. Promote ethical behavior, integrity, and responsible business practices at all levels of the organization. Regular training and awareness programs can reinforce these values and ensure that ESG considerations are integrated into daily operations.

Stakeholder Engagement

Incorporate stakeholder perspectives into your governance structures. Involve stakeholders in decision-making processes, seek their input, and consider their expectations and concerns. Establish mechanisms for stakeholder feedback, such as advisory panels or regular engagement sessions. By including diverse stakeholder perspectives, you ensure that your governance structures reflect a broad range of interests and foster trust and collaboration.

Continuous Improvement

Regularly review and assess the effectiveness of your governance structures and processes. Monitor the implementation of your ESG strategy and identify areas for improvement. Engage in benchmarking exercises, seek external feedback, and stay updated on emerging best practices in ESG governance. Continuously adapt and enhance your governance structures to ensure their relevance and effectiveness in a dynamic business environment.

Implementing robust governance structures provides the necessary oversight and accountability to drive your organization’s ESG strategy. By embedding ESG considerations into decision-making processes, fostering transparency and ethical behavior, and engaging stakeholders, you establish a solid foundation for the successful implementation of sustainable practices. Strong governance structures support the integration of ESG principles throughout your organization, enabling you to create long-term value while effectively managing risks and opportunities.

How to develop an ESG strategy – Integrate ESG into Operations

To develop a comprehensive ESG strategy, it is essential to embed ESG considerations into all aspects of your organization’s operations. By integrating ESG principles into your supply chain management, product development, and overall business practices, you can promote sustainable practices and enhance your environmental and social performance. Here are some key steps to integrating ESG into your operations

Policy Development

Develop clear and comprehensive policies that promote sustainable practices across your organization. These policies should outline your commitment to ESG principles and provide guidelines for decision-making and implementation. Consider developing policies that cover areas such as responsible sourcing, waste reduction, energy efficiency, water management, and biodiversity conservation. Ensure that these policies are aligned with your ESG priorities and industry standards.

Supply Chain Management

Assess and enhance the sustainability of your supply chain. Engage with suppliers to promote responsible sourcing practices, ethical labor standards, and environmental stewardship. Establish criteria for selecting suppliers based on their ESG performance and collaborate with them to improve sustainability outcomes. Regularly monitor and evaluate supplier compliance with ESG requirements, and work towards building long-term, sustainable partnerships.

Product Development

Incorporate ESG considerations into your product development process. Conduct life cycle assessments and environmental impact analyses to evaluate the environmental and social impacts of your products throughout their entire life cycle. Identify opportunities to minimize negative impacts, such as reducing resource consumption, optimizing packaging, or using eco-friendly materials. Additionally, consider incorporating social factors, such as product safety, human rights considerations, and customer well-being, into your product development decisions.

Waste Reduction and Circular Economy

Implement strategies to reduce waste generation and promote a circular economy within your organization. Develop recycling and waste management programs to minimize landfill waste and maximize resource recovery. Encourage product reuse, repair, and recycling initiatives. Explore opportunities for product redesign that incorporate circular economy principles, such as designing products with recyclable or biodegradable materials.

Energy Efficiency and Conservation

Implement measures to improve energy efficiency and conservation within your operations. Conduct energy audits to identify areas of energy waste and implement energy-saving technologies and practices. Encourage employee engagement and awareness to promote energy-saving behaviors. Consider adopting renewable energy sources and explore opportunities for on-site generation or purchasing renewable energy credits.

Stakeholder Engagement and Collaboration

Engage with stakeholders, including employees, customers, suppliers, and local communities, to gather insights and collaborate on sustainable initiatives. Seek input on improving operational practices, address concerns, and incorporate feedback into decision-making processes. Foster partnerships and collaborations with external organizations, industry peers, and research institutions to share best practices, learn from each other, and drive collective impact.

Monitoring and Reporting

Establish systems to monitor and measure the effectiveness of your ESG integration efforts. Develop key performance indicators (KPIs) that align with your ESG priorities and track progress over time. Implement regular monitoring and reporting mechanisms to assess the environmental and social performance of your operations. Transparently communicate your progress and achievements to stakeholders, demonstrating your commitment to ESG integration.

By integrating ESG considerations into your operations, you can drive sustainable practices, reduce environmental impacts, and enhance social performance throughout your value chain. This integration fosters innovation, enhances operational efficiency, and strengthens your organization’s reputation as a responsible and sustainable business. Ultimately, by embedding ESG principles into all aspects of your operations, you contribute to a more sustainable and resilient future.

How to develop an ESG strategy – Measure and Report Progress

Implementing a robust monitoring and reporting system is crucial for tracking your organization’s progress towards its ESG goals. By measuring and reporting your ESG performance, you can demonstrate transparency, accountability, and continuous improvement. Here are some key steps to effectively measure and report your progress

Establish Key Performance Indicators (KPIs)

Identify and establish a set of relevant ESG KPIs that align with your ESG priorities and goals. These indicators should cover environmental, social, and governance aspects that are most material to your organization and industry. Examples of ESG KPIs include carbon emissions, energy consumption, diversity and inclusion metrics, employee engagement scores, and ethical governance practices. Ensure that your KPIs are specific, measurable, attainable, relevant, and time-bound (SMART).

Utilize ESG Frameworks and Standards

Utilize established frameworks and standards to guide your ESG measurement and reporting efforts. Frameworks such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) provide comprehensive guidelines for reporting on ESG topics. These frameworks ensure consistency, comparability, and credibility in your reporting. Adopting recognized frameworks also helps you meet the expectations of investors, stakeholders, and industry peers.

Collect and Analyze Data

Implement robust data collection processes to gather relevant information for your ESG indicators. Engage with different departments and stakeholders within your organization to collect data on environmental impacts, social performance, and governance practices. Utilize internal systems, surveys, audits, and external data sources to obtain a comprehensive view of your ESG performance. Ensure data accuracy, integrity, and consistency across reporting periods.

Regular Reporting

Develop a structured reporting process to communicate your ESG performance to stakeholders. Determine the appropriate reporting frequency, whether it’s annually, semi-annually, or quarterly, depending on your organization’s needs and stakeholder expectations. Prepare a comprehensive report that includes a narrative on your ESG strategy, progress against goals, key achievements, challenges, and future targets. Use visualizations, case studies, and qualitative information to enhance the understanding and impact of your report.

Stakeholder Engagement

Engage with stakeholders to gather their perspectives and feedback on your ESG reporting. Seek input on the relevance and usefulness of your reported information. Consider conducting stakeholder surveys, focus groups, or consultations to better understand their expectations and information needs. Actively incorporate stakeholder feedback into your reporting process to enhance its value and responsiveness.

Assurance and Verification

Consider obtaining external assurance or verification of your ESG reporting to enhance its credibility and transparency. External assurance provides independent verification of the accuracy, completeness, and reliability of your reported information. It instills confidence among stakeholders, particularly investors, that your reporting is robust and trustworthy. Engage qualified assurance providers with expertise in ESG reporting and adhere to recognized assurance standards.

How to develop an ESG strategy – Continuous Improvement

Treat your ESG reporting as an iterative process that evolves over time. Continuously review and refine your reporting methodologies, metrics, and communication strategies. Identify areas for improvement and implement enhancements based on stakeholder feedback, emerging best practices, and changes in ESG frameworks or standards. Regularly assess the effectiveness of your reporting in meeting stakeholder needs and aligning with evolving ESG trends.

By implementing a robust monitoring and reporting system, you can effectively measure and communicate your organization’s progress in achieving its ESG goals. Transparent reporting builds trust with stakeholders, enhances reputation, and fosters accountability. It also enables you to identify areas for improvement, drive positive change, and demonstrate the value and impact of your sustainability initiatives.

How to develop an ESG strategy – Continual Improvement

ESG is not a one-time endeavor but a journey of continuous improvement. To stay relevant and effective, it is essential to regularly review and update your ESG strategy. By embracing a mindset of continuous improvement, you can adapt to evolving trends, regulations, and stakeholder expectations. Here are key elements to consider for continual improvement

Monitor ESG Trends

Stay informed about emerging ESG trends, industry developments, and regulatory changes that may impact your organization. Keep a pulse on evolving sustainability practices, technological advancements, and societal expectations. Engage with industry associations, participate in conferences, and follow reputable sources of ESG information to gain insights and identify opportunities for improvement.

Stakeholder Feedback

Actively seek feedback from your stakeholders, including employees, investors, customers, communities, and advocacy groups. Create channels for open dialogue and collect input on your ESG initiatives. Regularly engage in conversations with stakeholders to understand their evolving expectations and concerns. Use their feedback to inform your strategy and make necessary adjustments to address their needs effectively.

Benchmark and Learn from Best Practices

Benchmark your ESG performance against industry peers, competitors, and leading organizations known for their sustainability practices. Identify leaders in your sector and beyond who are excelling in specific ESG areas and learn from their best practices. Engage in knowledge sharing, attend industry conferences, and participate in sustainability networks to gain insights and inspiration for improvement.

Embrace Innovation

Foster a culture of innovation within your organization and encourage employees to think creatively about sustainability challenges. Embrace new technologies, processes, and business models that drive sustainable growth. Explore opportunities to integrate innovative solutions into your operations, products, and services. Innovation can help you identify more efficient and impactful ways to address ESG issues and differentiate your organization in the marketplace.

Collaborate and Engage in Partnerships

Collaborate with external organizations, research institutions, NGOs, and other stakeholders to tackle complex ESG challenges collectively. Engage in partnerships that promote knowledge sharing, collaboration, and collective action. Collaborative initiatives can expand your reach, leverage shared resources, and create synergy to address systemic sustainability issues.

Set Stretch Goals

Continually challenge yourself by setting ambitious yet achievable ESG goals. Set targets that go beyond regulatory compliance and industry norms. Embrace aspirational goals that drive meaningful change and push the boundaries of what is currently considered feasible. These stretch goals can inspire innovation, mobilize resources, and galvanize your organization towards transformative ESG outcomes.

Embed ESG in Decision-Making

Integrate ESG considerations into your decision-making processes at all levels of your organization. Ensure that ESG factors are systematically evaluated when making strategic, operational, and investment decisions. Embedding ESG into decision-making creates a culture of sustainability and ensures that sustainable considerations are at the forefront of your organizational practices.

How to develop an ESG strategy – Regularly Update Your Strategy

Regularly review and update your ESG strategy to reflect the evolving landscape and lessons learned. Assess the effectiveness of your current initiatives, measure progress against goals, and identify areas for improvement. Be willing to adapt and adjust your strategy based on emerging opportunities, risks, and stakeholder expectations. Continuously communicate your updated strategy to ensure alignment and engagement across your organization.

By embracing a culture of continual improvement, you can maintain the relevance and effectiveness of your ESG strategy. Through ongoing monitoring, stakeholder engagement, learning from best practices, embracing innovation, and setting stretch goals, you can drive positive change, enhance your sustainability performance, and contribute to a more sustainable future.

How to develop an ESG strategy – Conclusion

Developing an effective ESG strategy is not just a responsible choice; it is a strategic imperative for organizations that aim to make a positive impact on the environment, society, and governance practices. By following the blueprint outlined in this blog, you can align your business with sustainability principles, foster stronger stakeholder relationships, and drive meaningful change within and beyond your organization.

By embracing the power of ESG, you unlock new opportunities for innovation, growth, and long-term success. A well-executed ESG strategy can help you differentiate your brand, attract socially conscious investors, and build trust among consumers who are increasingly demanding sustainability commitments from businesses. Furthermore, integrating ESG considerations into your operations can enhance operational efficiency, mitigate risks, and reduce costs over time.

But ESG goes beyond financial benefits. It is a way to contribute to a sustainable future for your organization and the world. By addressing environmental challenges such as climate change, resource depletion, and pollution, you can play a role in preserving the planet for future generations. By fostering diversity and inclusion, prioritizing employee welfare, and engaging with communities, you contribute to a more equitable and inclusive society. And by adopting transparent and ethical governance practices, you build trust and confidence in your organization’s leadership.

As you embark on your ESG journey, remember that it is an ongoing commitment. Continuously reassess your strategy, adapt to changing circumstances, and stay informed about emerging trends and best practices. Engage with stakeholders, seek feedback, and collaborate with others to amplify your impact. By embracing ESG, you have the opportunity to create a positive legacy for your organization and contribute to a more sustainable future for all.

Embrace the power of ESG, unlock new opportunities, build resilience, and create a sustainable future for your organization and the world. Together, we can drive positive change and build a more sustainable and prosperous world for generations to come.