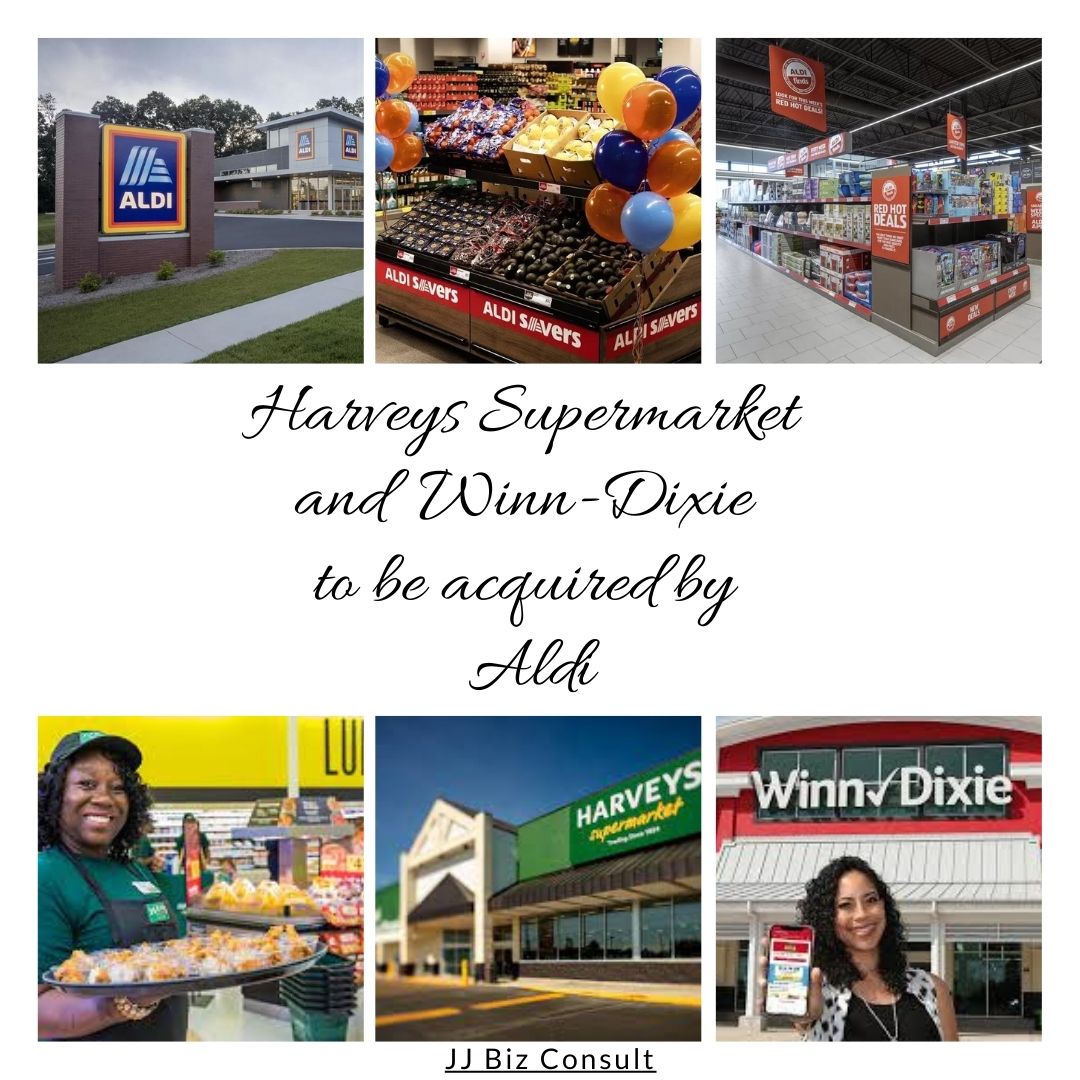

Harveys Supermarket and Winn-Dixie to be acquired by Aldi

Harveys Supermarket and Winn-Dixie to be acquired by Aldi: The German grocer has entered into an agreement to buy nearly 400 locations from the two supermarket chains.

The Harveys Supermarket & Winn-Dixie deal is worth an estimated $2.9 billion

The deal is worth an estimated $2.9 billion, which is equal to 2900 million dollars. This is a significant amount of money, and it is a reflection of the value of the Winn-Dixie and Harveys Supermarket chains.

The $2.9 billion price tag is based on the estimated fair market value of the two chains. This is calculated by taking into account a number of factors, including the number of stores, the revenue of the stores, and the location of the stores.

The acquisition is a major coup for Aldi. The company is a discount grocer, and it has been growing rapidly in recent years. The acquisition of Winn-Dixie and Harveys Supermarket stores will give Aldi a significant presence in the Southeast, which is a key growth market.

The acquisition is also a sign of the consolidation that is happening in the supermarket industry. As consumers increasingly shop for groceries online, traditional supermarkets are under pressure to merge or acquire other companies in order to stay competitive.

The $2.9 billion price tag is a significant investment by Aldi, but it is a bet that the company believes will pay off. The acquisition will give Aldi a larger presence in the Southeast, which is a key growth market. It will also allow Aldi to compete with other discount grocers, such as Lidl and Walmart.

The acquisition is expected to close in early 2024. It will be interesting to see how the acquisition plays out in the long run. Aldi is a well-known and respected brand, and it has a loyal customer base. However, it will need to be careful not to alienate Winn-Dixie and Harveys Supermarket customers. The company will also need to invest in the stores in order to make them competitive.

Overall, the acquisition of Winn-Dixie and Harveys Supermarket stores is a major move by Aldi. It is a sign of the company’s ambition and its commitment to growth in the United States. It will be interesting to see how the acquisition plays out in the years to come.

The acquisition will add about 400 stores to Aldi’s U.S. portfolio

The acquisition of Winn-Dixie and Harveys Supermarket stores will add about 400 stores to Aldi’s U.S. portfolio, bringing the total to over 2,400 stores. This is a significant increase in Aldi’s presence in the United States.

Aldi currently has about 2,000 stores in the United States. The acquisition will add stores in Florida, Alabama, Georgia, Louisiana, and Mississippi. These are all states where Aldi is not currently present, or where its presence is limited.

The acquisition will also give Aldi a larger presence in the Southeast, which is a key growth market for the grocery industry. The Southeast is home to a large and growing population, and it is a region where consumers are increasingly looking for value.

Osmotics SkinCare™ Osmotics SkinCare™ is a Global Anti-Aging Beauty Brand.

The acquisition is a major coup for Aldi. The company is a discount grocer, and it has been growing rapidly in recent years. The acquisition of Winn-Dixie and Harveys Supermarket stores will give Aldi a significant presence in the Southeast, which is a key growth market.

The acquisition is also a sign of the consolidation that is happening in the supermarket industry. As consumers increasingly shop for groceries online, traditional supermarkets are under pressure to merge or acquire other companies in order to stay competitive.

The acquisition of Winn-Dixie and Harveys Supermarket stores is a major move by Aldi. It is a sign of the company’s ambition and its commitment to growth in the United States. It will be interesting to see how the acquisition plays out in the years to come.

Aldi plans to convert some of the stores to its own format, while others will continue to operate as Winn-Dixie and Harveys Supermarket stores.

Aldi plans to convert some of the Winn-Dixie and Harveys Supermarket stores to its own format, while others will continue to operate as Winn-Dixie and Harveys Supermarket stores. The decision of which stores to convert will be based on a number of factors, including the location of the store, the condition of the store, and the customer base.

Aldi is a discount grocer, and its stores are known for their low prices and limited selection. The company’s stores are typically smaller than traditional supermarkets, and they have a self-service checkout system.

Winn-Dixie and Harveys Supermarket stores are more traditional supermarkets. They have a wider selection of products, and they offer a variety of services, such as deli counters and pharmacies.

Aldi is likely to convert stores that are in good condition and that are located in areas where there is a demand for its discount format. The company is also likely to convert stores that are close to other Aldi stores.

The stores that are not converted will continue to operate as Winn-Dixie and Harveys Supermarket stores. These stores will be rebranded and updated, but they will retain their traditional supermarket format.

It is not yet clear how many stores Aldi will convert. The company has said that it will make a decision on a case-by-case basis.

The decision to convert some of the stores to Aldi’s format is a sign of the company’s ambition. Aldi is a growing company, and it is looking to expand its presence in the United States. The acquisition of Winn-Dixie and Harveys Supermarket stores is a major step in this expansion.

The decision to keep some of the stores as Winn-Dixie and Harveys Supermarket stores is also a sign of Aldi’s commitment to the Southeast. The company is aware that there is a demand for traditional supermarkets in the region, and it is willing to meet this demand.

It will be interesting to see how the acquisition of Winn-Dixie and Harveys Supermarket stores plays out in the long run. Aldi is a new player in the Southeast, and it will be interesting to see how it competes with the established supermarkets in the region.

The deal is expected to close in early 2024

The deal is expected to close in early 2024. This is because the deal is still subject to regulatory approval. The Federal Trade Commission (FTC) will need to review the deal to ensure that it does not violate antitrust laws.

The FTC is expected to take a few months to review the deal. Once the FTC has approved the deal, it will then need to be approved by the shareholders of Southeastern Grocers, the parent company of Winn-Dixie and Harveys Supermarket stores.

If the deal is approved by the FTC and the shareholders of Southeastern Grocers, it is expected to close in early 2024.

Here are some of the factors that could delay the closing of the deal:

- The FTC could take longer than expected to review the deal.

- The shareholders of Southeastern Grocers could vote against the deal.

- There could be other unforeseen issues that delay the closing of the deal.

However, Aldi and Southeastern Grocers are confident that the deal will close in early 2024. The acquisition is a major move by Aldi, and the company is eager to expand its presence in the United States.

Overall, the acquisition of Winn-Dixie and Harveys Supermarket stores is a major move by Aldi. It is a sign of the company’s ambition and its commitment to growth in the United States. It will be interesting to see how the acquisition plays out in the years to come.

Scotland Makes History with Free Menstrual Products