Green Tea world market a Sizable US$26.16 Billion

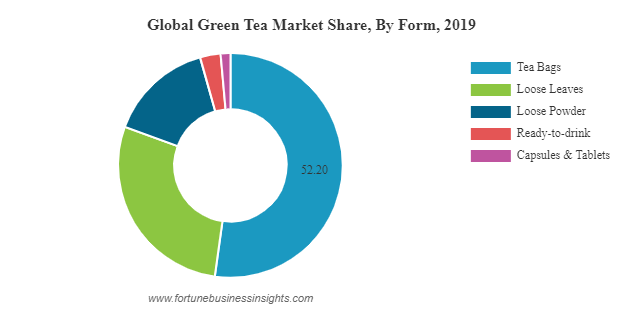

Green Tea world market a Sizable US$26.16 Billion by 2028. A recent report by Vantage Market Research reveals that the global green tea market was worth US$13.41 billion in 2021 and is anticipated to hit US$26.16 billion by 2028. According to the report, the tea bag and commercial green tea segments will grow rapidly in the coming years, while the sale of green tea at commercial locations will also increase, driven by the growing number of health-conscious consumers. Moreover, the availability of green tea products from various brands at reasonable prices has motivated more customers to purchase green tea from supermarkets and hypermarkets. The report provides an overview of the market, including segmentation, analysis, competitive landscape, and regional trends.

The factors and trends that impact the global Green Tea market.

The global green tea market is influenced by various factors, as reported by Vantage Market Research. Among these factors are the increasing awareness of health benefits associated with green tea, such as boosting metabolism and reducing the risk of cancer and cardiovascular disease. The trend towards natural and organic products is also driving demand for green tea as it is made from minimally processed Camellia sinensis leaves. Additionally, the expansion of tea culture around the world is increasing the popularity of green tea, as more consumers explore different types and flavors. The rise in disposable income levels is also fueling growth in the green tea market as consumers are more likely to spend money on premium and specialty teas. Furthermore, companies are adopting innovative marketing and promotional strategies, such as product launches and new flavor introductions, to increase the visibility and popularity of green tea.

Factors limiting the growth of the Green Tea Market

- Expensive Premium and Specialty Teas: The high cost of green tea, particularly premium and specialty teas, can limit growth in the market, as some consumers may opt for less expensive alternative beverages.

- Increasing Competition from Alternative Beverages: Growing popularity of alternative beverages like coffee and herbal tea may draw consumers away from green tea, reducing growth in the market.

- Limited Awareness in Some Regions: The lack of awareness and consumption of green tea in some regions can limit its growth potential.

- Stringent Regulations: The strict regulations on the production and sale of green tea can increase production costs and limit the availability of certain products.

- Fluctuating Raw Material Prices: Green tea production depends on the Camellia sinensis leaves, which are subject to fluctuations in price due to weather conditions and crop yields, leading to variations in production costs and affecting growth in the market.

Despite these restraints, the green tea market is still growing, driven by increasing demand for natural and healthy products, as well as the expanding tea culture around the world. Green tea companies are working to overcome these challenges by offering high-quality products, utilizing innovative marketing strategies, and exploring new distribution channels.

Suggestions for the Green Tea Market

To promote growth in the green tea market, companies are advised to concentrate on providing high-quality products that satisfy consumers’ demands and preferences. This will help in building customer loyalty and increase market growth. Additionally, companies can enhance the visibility and appeal of green tea by using innovative marketing and promotional strategies, such as product launches, new flavors, and targeted advertising campaigns. Expanding their reach by exploring new distribution channels, such as online sales and specialty tea shops, can also lead to increased sales. Companies should also focus on sustainability, which includes utilizing eco-friendly packaging and sourcing materials from sustainable sources, to differentiate themselves from competitors. Collaborating with health and wellness brands can increase the popularity of green tea among consumers by promoting its health benefits. Research and development investment can enable companies to create new and innovative green tea products that cater to consumers’ evolving needs and preferences. The report concludes that by tackling challenges and seizing opportunities in the market, companies can position themselves for long-term success.

Future developments in the Green Tea Market

The report highlights several emerging trends that are expected to shape the Green Tea market in the coming years:

- Rising demand for organic and natural products: Consumers are increasingly seeking out organic and natural products, and this trend is expected to continue in the green tea market.

- Growing popularity of specialty teas: Specialty teas, such as matcha and sencha, are becoming more popular among consumers, which is expected to drive growth in the green tea market.

- Expansion of the online sales channel: Online sales of green tea products are expected to grow significantly in the coming years, as more consumers opt for the convenience of online shopping.

- Increasing demand for functional teas: Functional teas, which are infused with additional ingredients such as herbs and spices, are becoming more popular among consumers who are looking for health and wellness benefits.

- Innovation in packaging: Companies are exploring new packaging materials and designs to make their green tea products stand out on the shelves and appeal to consumers.

Overall, these trends indicate that the green tea market is likely to continue growing in the coming years, as companies adapt to changing consumer preferences and expand their offerings.

Regional Analysis

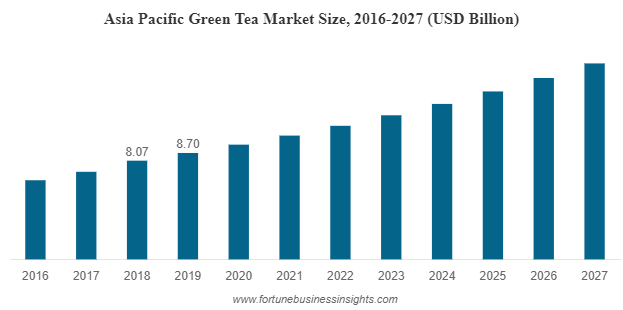

The market for green tea is analyzed regionally, and Asia Pacific is identified as the largest market due to high consumption in countries such as China, India, and Japan. These countries have a strong cultural significance for green tea, which is widely consumed for its potential health benefits. In recent years, there has been an increase in specialty tea shops and cafes that offer premium green tea products in the region. North America is also a significant market for green tea, driven by a growing interest in healthy and natural beverages. Green tea-based products, including bottled green tea, matcha green tea, and green tea-infused food and beverage products, are becoming increasingly popular in the region. In Europe, green tea has a strong following, particularly in the United Kingdom, Germany, and France. The region has seen a rise in specialty tea shops and online tea retailers offering premium green tea products. The rest of the world, including South America, Africa, and the Middle East, is also experiencing growth in the green tea market due to increasing consumer awareness of its potential health benefits and the trend towards healthier beverage options. The global green tea market is expected to continue to grow in the future, driven by increasing demand for healthy and natural beverages and the popularity of specialty tea shops and premium green tea products.

Source: WorldTeaNews

Fortune Business Insights on Green Tea

Source: Fortune Business Insights

World Tea Market & Who Drinks Tea

Tea is the second most popular drink in the world, after water. In 2020, approximately 7 billion metric tons of tea were produced worldwide, with China, India, Kenya, Sri Lanka, and Indonesia being the main tea producers in terms of volume. The global tea market size is expected to reach $266.7 billion by 2025, according to the Statista Consumer Market Outlook.

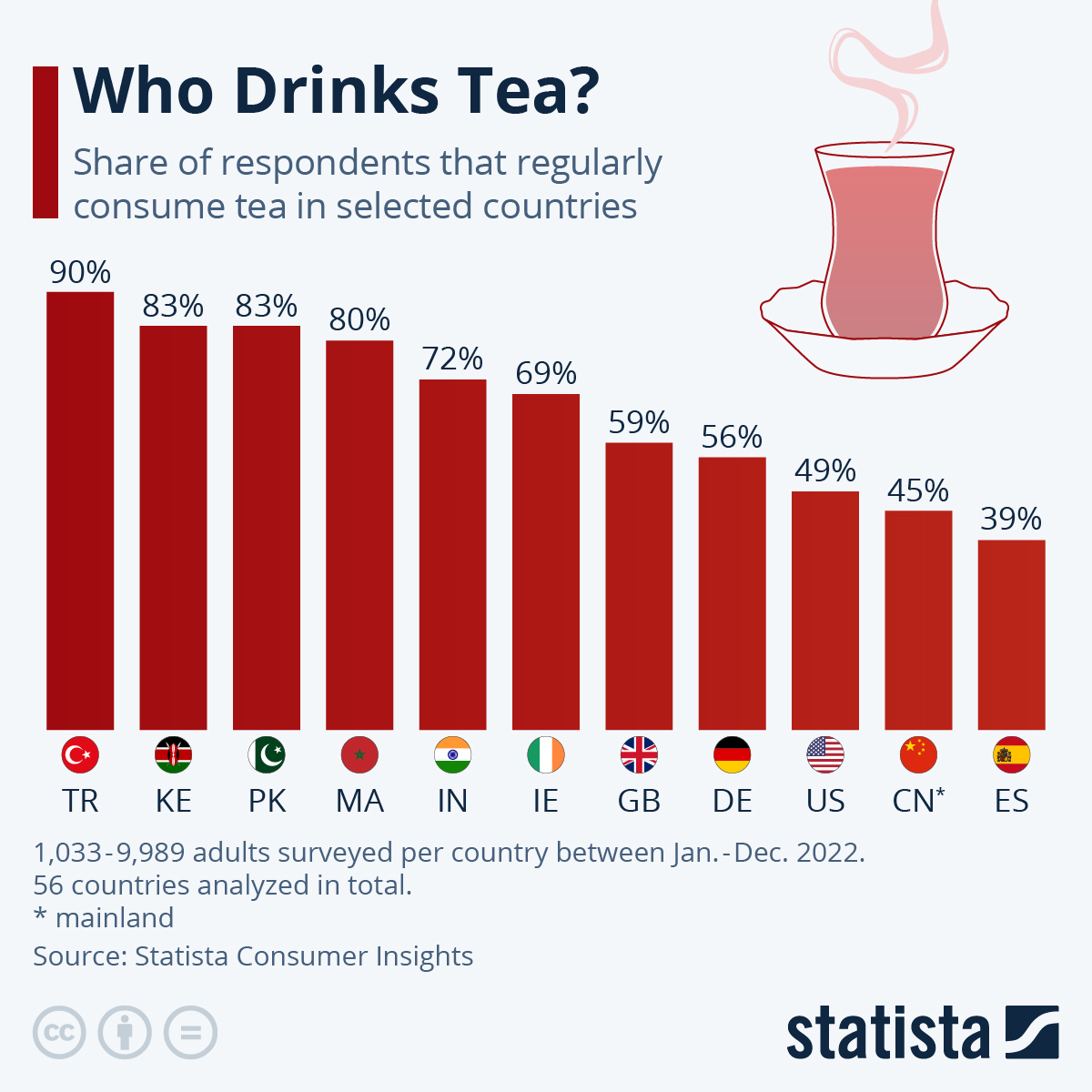

A chart based on data from Statista’s Consumer Insights illustrates the percentage of tea drinkers in selected countries. Turkey had the highest percentage of tea drinkers in 2022, with nine out of ten people reporting that they regularly drink tea. Kenya, a significant producer and exporter of tea, also had a high rate of tea consumption, with 83% of respondents saying they regularly drink tea. Meanwhile, the United Kingdom, known for its love of tea, had a slightly lower rate, with 59% of people regularly drinking it. This is about ten percentage points lower than the neighboring tea drinking country Ireland. Spain had the lowest rate of tea consumption, with just over a third of people regularly drinking tea.

The World Tea Conference and Expo 2023 is starting today in Las Vegas and will run from March 27-29.

You will find more infographics at Statista

You will find more infographics at Statista

An Overview of Key Countries that Produce and Export Tea

Mozambique and Malawi

Before delving into the major tea producing and exporting countries, it’s important to acknowledge the impact of cyclone Freddy on Mozambique and Malawi. The death toll has already surpassed 500 and is expected to increase. This event serves as a warning of the effects of climate change that can have a significant impact on the tea industry.

It’s worth noting that Mozambique and Malawi are emerging as important origins for orthodox and organic tea movements. For those unfamiliar with these origins, the centenary of Satemwa Tea & Coffee Estate in Malawi can provide insights into the current state of the tea industry in Southern Africa.

Turkey

The tea industry worldwide expresses its condolences and wishes for a quick recovery to Türkiye after the devastating earthquake that occurred last month. This nation, which has a high tea consumption rate of over 3 kgs per person per year, experienced a slightly lower tea crop in 2022, but it is expected to recover fully in 2023, depending on the climate. In the past two years, the country has faced challenges such as the loss of migrant labor during the tea harvesting season due to COVID-19 lockdowns and the impact of fertilizer costs because of the war in the North, which heavily impacted production. However, these challenges are mostly behind, and the region’s black sea tea-growing industry is now producing not only traditional Cay but also greens, whites, and other specialties, as local artisans thrive and new markets (thanks to e-commerce) introduce more people to Türkiye’s potential.

Vietnam

Vietnam, a country of similar tea production size to Türkiye, is an unexpected participant in the world tea export market, as much of its tea is smuggled into China, which doesn’t receive export recognition. This unprocessed tea is low in value and goes through final processing only after it is imported. However, the more significant export has been black tea, which has competed aggressively in the global market, particularly after the upheaval in Sri Lanka. Therefore, in 2023, we can anticipate Vietnam’s export efforts to continue and expand.

China

China, the largest producer and consumer of tea globally, is anticipating a typical harvest season this year. Nevertheless, the economic downturn seen in the first quarter of the year could result in a shift towards lower-priced tea products from China. Despite this, the tea volumes are expected to perform well. Additionally, as COVID-19 restrictions ease and freight rates stabilize, we can expect more efficient port operations and smoother importing and exporting processes.

Argentina

Argentina’s tea season started poorly but has since recovered, although the industry as a whole has not. Reports indicate that some farmers are switching to other crops like yerba mate, while processing companies are struggling due to Argentina’s financial crisis and rising global energy costs, which are a significant part of the production cost in this highly automated origin. Additionally, business has been slow for Argentina due to the slow recovery of North America’s iced tea consumption after COVID (Argentina is a significant component in iced tea blends in North America). However, stocks are high, and as out-of-home consumption returns to normal, demand for new shipments is still low.

Sri Lanka

Sri Lanka, which is among the major tea exporting countries, is slowly recovering from a debt and political crisis that had a negative impact on their tea production. Due to reduced ability to purchase fertilizers, their tea and rice crops were affected, and the 2022 tea crop is expected to be just under 50 million kilograms, which is lower than the previous year. This had two major consequences. Firstly, prices at auction increased as the availability of tea dropped below the traditional market demands, mainly in Russia, central Asia, and the Middle East. Secondly, traditional Sri Lankan tea consumers were forced to look for alternatives at acceptable prices from countries such as India, Vietnam, and East Africa. As a result, these countries benefited from the situation. Although Sri Lanka’s tea production is expected to recover, traditional markets may not be as loyal to Ceylon tea as before, as they have now found alternative options that are acceptable, which opens up the competition to any country capable of producing orthodox tea.

India

India, which benefited from Sri Lanka’s crisis, is facing its own challenges. Climate change is affecting Assam, with pests becoming more prevalent and making it harder to meet the maximum residue limits (MRLs) of more stringent markets for tea sales. However, India has a large and growing domestic market that is currently the focus of its attention. There is a two-tier system in Assam with plantation companies facing higher costs due to obligations to workers and families, while the bought-leaf sector is more competitive but poses risks to product and personnel safety. Shareholder pressure has also seen plantation owners divest or sell their businesses. Darjeeling has been impacted by political strikes and an aging bush population, with rains teas selling below cost of production. This situation raises questions about whether specialty and commoditized tea grades should be sold side-by-side. The largest Assam plantation company is in a predicament, and the new owners are unlikely to have the same export focus as previous owners, further reducing export quantities.

Nepal

Nepal’s smallholder sector is gaining recognition for producing teas that are similar to those in Darjeeling. Some of these teas are sold in competition with Darjeeling teas, while others are exported to Darjeeling at a lower cost. The legacy costs and agreements in Darjeeling have caused problems, leading to decreased competitiveness for the region.

Kenya

Meanwhile, in Kenya, the issue has been less about the cost of production and more about selling prices. Political interference has focused on increasing productivity for smallholder farmers without considering the impact on the market. The result has been the continued expansion of mediocre tea, which has negatively affected the market. Blame can be placed on multinationals and programs set up with certifiers, which prioritize efficiency and output over commercial sustainability. Recently, there has been an attempt to manipulate the market with a minimum auction price for teas, regardless of quality. This has led to out lots doubling or even tripling in price week on week. Despite this, more independent farmers and producers are deviating from mediocre manufacturing and producing exceptional CTC and orthodox teas. However, the growth of smallholder production worldwide needs to be balanced with a thorough understanding of the benefits that organized plantation sectors provide. Central skilled management of everything from agronomy to production, social welfare, environmental protection, and legislative compliance is attractive for everyone in the industry. Creating this within a smallholder production base is difficult and requires efforts to ensure these values are not lost during the transition.

Source: WorldTeaNews

Surging Iced Coffee Market is US$ 1.2 billion in 2021

The Top Digital Marketing Trends to Watch in 2023