Powerball Jackpot – The largest ever US$ 2.3 Billion up for grabs. The next drawing will take place just before 11 p.m. EST on Wednesday, Nov. 9, 2022 with a $2.3 billion advertised jackpot.

Earlier Report by CNBC on the Largest Ever Powerball Jackpot

Whoever wins the next Powerball jackpot will be the recipient of the largest lottery prize ever awarded.

The tax bill will be equally impressive.

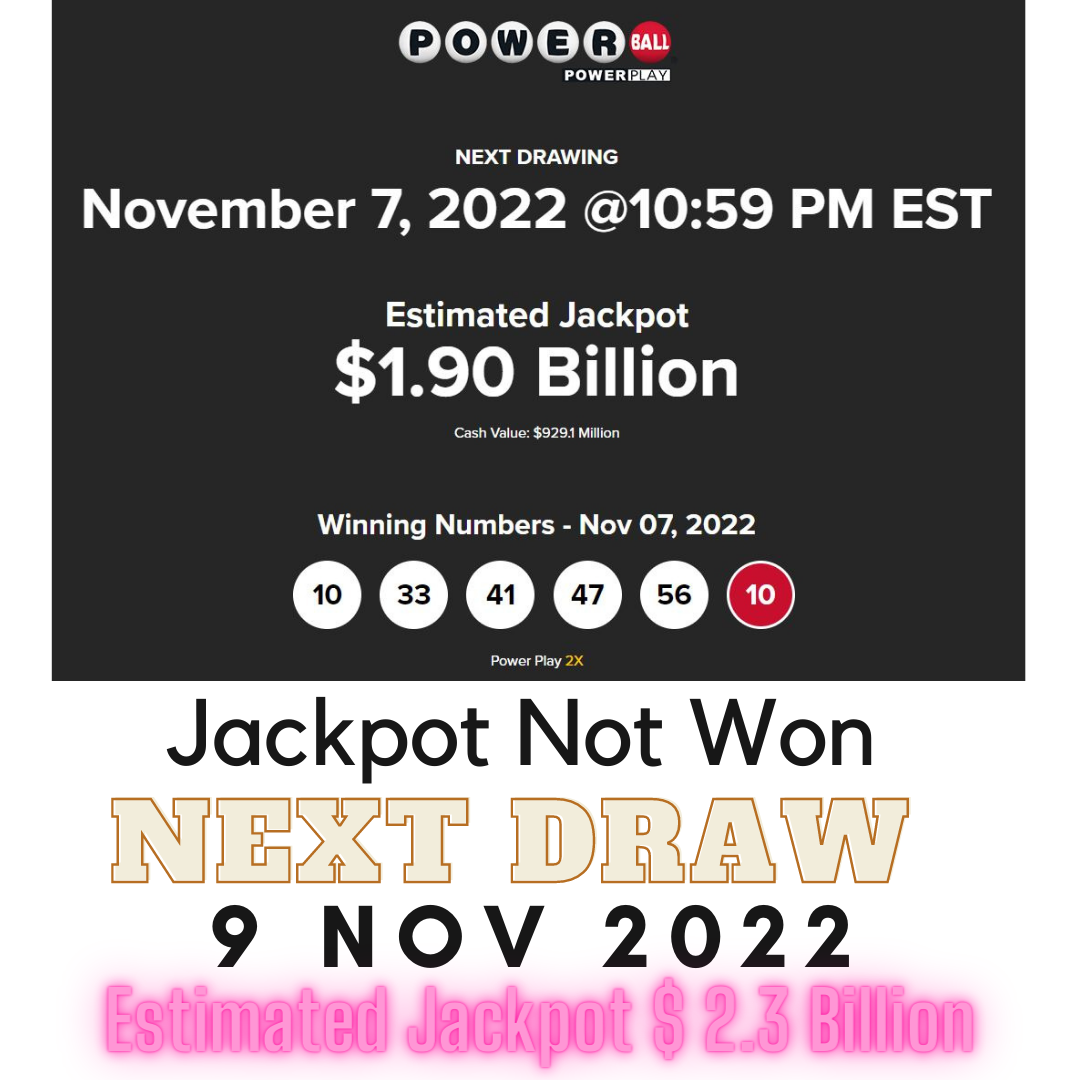

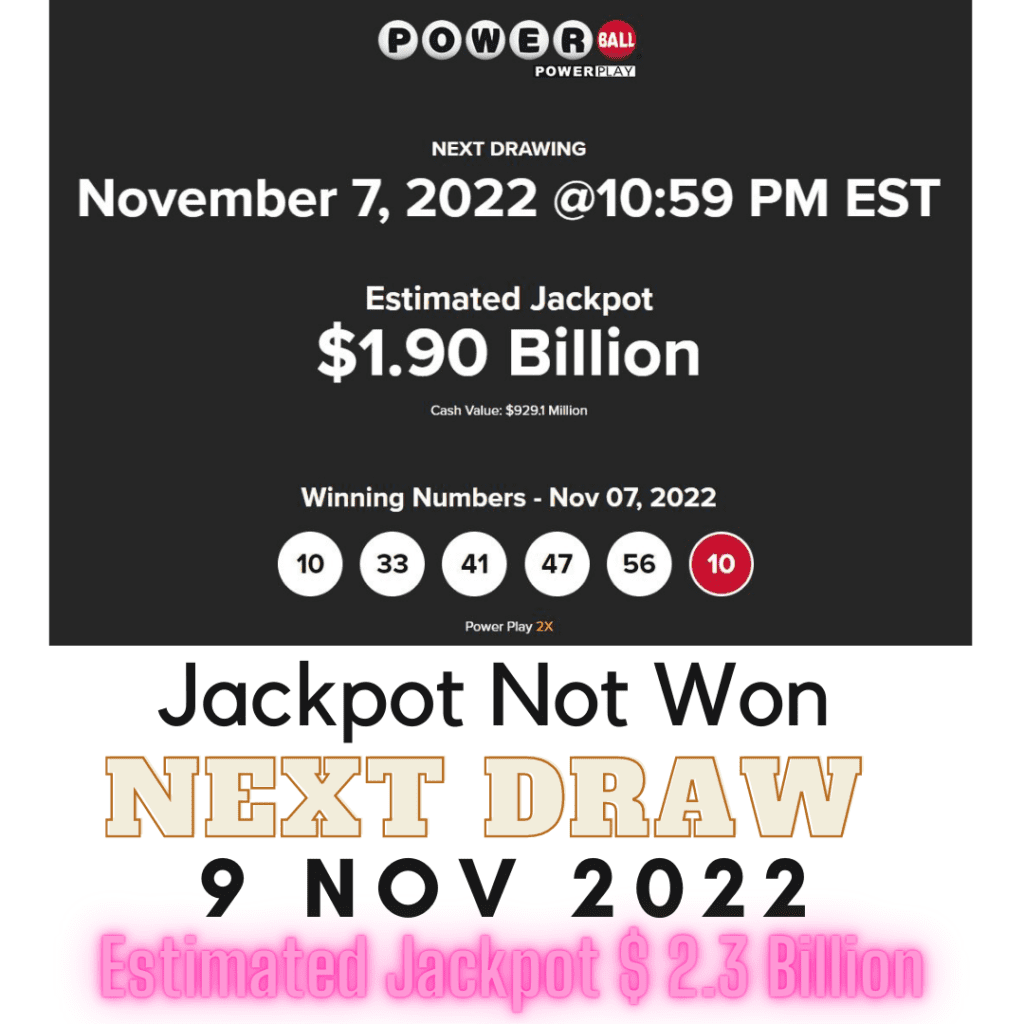

The Powerball jackpot increased after no one matched all six numbers drawn on Saturday. It’s now an estimated $1.9 billion if taken as an annuity spread over three decades and $929.1 million if received as an upfront, lump sum of cash for Monday night’s drawing — a nearly $1 billion difference. Source: CNBC

Latest Report by Quartz on the Largest Ever Powerball Jackpot

After delaying the drawing for more than ten hours due to security concerns, Powerball revealed the winning numbers for what was billed as the world’s largest lottery jackpot in history.

The numbers drawn for the white balls were 10, 33, 41, 47, and 56. The red Powerball number was 10. To win the jackpot, players must match all six numbers.

According to Powerball.net, there were no winners of the top prize, which means there will be another drawing on Wednesday with a $2.3 billion advertised jackpot.

How is Powerball played

Powerball can be played for $2 per ticket. Players must select 5 white balls from numbers 1-69 and 1 red Powerball from numbers 1-26. If a player matches all 6 of his numbers, he can win a huge jackpot.

The odds of matching all five numbers with the Powerball number and winning the jackpot are 1 in 292.2 million.

However, prior to 2015, Cue Balls were numbered 1-59 and Powerballs were numbered 1-35. This change makes players more likely to win small prizes, but less likely to hit the jackpot, and more likely for large numbers to grow to record sizes. Source CNN

What is the Tax payable on this Jackpot

What would that tax bill look like once you hit your mother’s veins? $223 million in savings.

However, the IRS may have more rights when taxing. The state’s top income tax rate is 37%, which applies to income over $539,900 for single taxpayers and $647,850 for married couples this year.

Next year, the top tax rate will apply to income above $578,125 (individuals) and $693,750 (couples). This means that an additional 13% (approximately $120.8 million) will go to the IRS unless you can reduce your taxable income by, for example, donating to charity.

So a total of $343.8 million went into federal funding, leaving $585.3 million. State taxes may apply depending on where you purchased your ticket and where you live. Some jurisdictions have no income tax or no tax on lottery winnings, while others impose top tax rates in excess of 10%.

On the other hand, if you choose an annuity amount, it will be taxed as it will be distributed annually and the tax rate at that time will apply.

Visit Related News on this site: Largest Lottery Jackpot in 2022 – US$ 1.337 Billion Won

Click Link below for Trending Deals on Eyewear

Vooglam Offical Website