Amazon MGM Acquisition: A Game-Changer in the Streaming Industry

Amazon MGM Acquisition: A Game-Changer in the Streaming Industry.

In a move that could reshape the landscape of the streaming industry, Amazon is reportedly in advanced talks to acquire MGM Studios for a whopping $9 billion. If this deal materializes, it would mark the largest acquisition in Amazon’s storied history and a significant milestone in the ever-evolving world of entertainment.

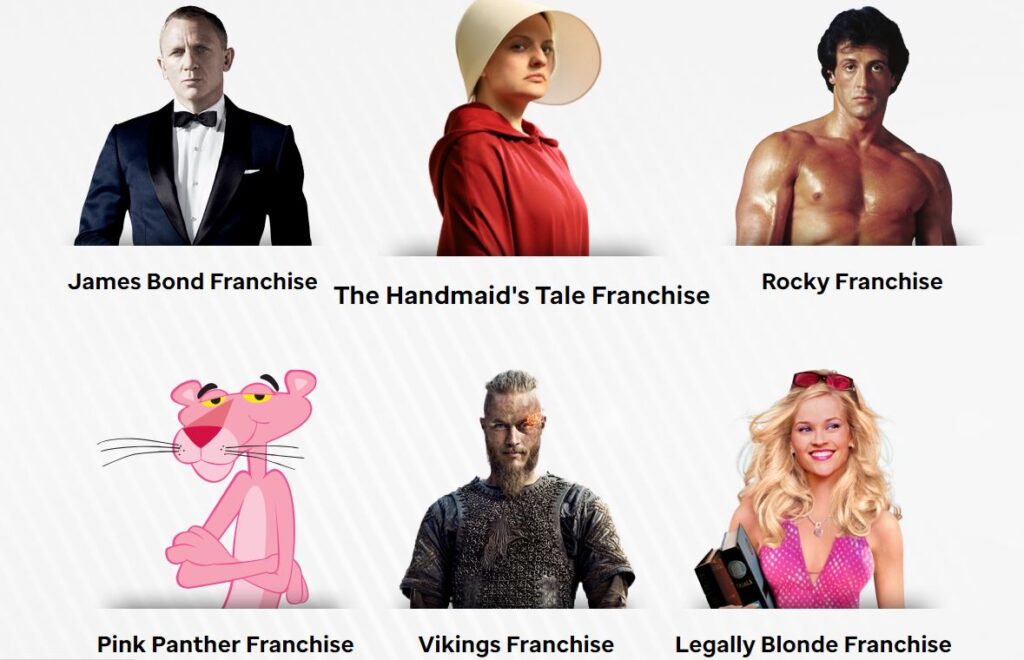

MGM Studios, with its rich history dating back to 1924, is a Hollywood giant renowned for its impressive library of over 4,000 films and 17,000 television shows. Among the crown jewels in MGM’s vast collection are iconic franchises like James Bond, Rocky, Pink Panther, and The Hobbit. These beloved series have a global fan base, making them a valuable asset for any streaming platform.

Amazon, of course, is no stranger to the entertainment industry. With its streaming service, Prime Video, the tech giant has been making waves in the competitive streaming arena. Offering a wide array of both original and licensed content, Amazon has given its audience access to critically acclaimed series such as “The Boys,” “Jack Ryan,” and “The Marvelous Mrs. Maisel.” However, with the potential acquisition of MGM, Amazon is poised to ascend to new heights in this rapidly expanding market.

So, what are the potential benefits of this colossal merger for Amazon?

- Expanded Content Library: The most obvious advantage is the sheer volume and quality of MGM’s content. By adding MGM’s extensive film and television collection to its arsenal, Amazon will have a substantial edge in catering to diverse audience preferences. This move could enable Amazon to enhance its offerings, luring more subscribers to its Prime Video service.

- Iconic Franchises: MGM’s iconic franchises, including James Bond and Rocky, have a global fan following. Leveraging these popular series can significantly boost Amazon’s subscriber base. The allure of exclusive access to these beloved classics might just be the tipping point for many viewers to opt for Amazon’s streaming platform.

- Production Capabilities: Amazon is no stranger to producing original content, but with MGM under its wing, it will have even greater production capabilities. This could lead to a surge in exclusive content for Prime Video, a key strategy in the battle for viewer attention.

However, with great opportunities come significant risks:

- Staggering Costs: The $9 billion price tag is not a small sum, and it remains to be seen whether Amazon can generate enough revenue from MGM’s assets to justify the substantial investment. The success of this acquisition hinges on how effectively Amazon can monetize its newfound content library.

- Antitrust Scrutiny: In today’s landscape, large mergers and acquisitions often face antitrust scrutiny from regulatory bodies. Amazon could encounter legal challenges and delays, potentially jeopardizing the deal.

- Integration Challenges: Integrating a massive entity like MGM into Amazon’s existing businesses will undoubtedly pose operational challenges. Harmonizing cultures, systems, and strategies can be a formidable task.

In conclusion, the acquisition of MGM is a major gamble for Amazon, but one that could yield immense rewards. With its deep pockets and vast resources, Amazon is well-positioned to capitalize on MGM’s rich content portfolio. If the deal goes through, it could be a significant catalyst for Amazon’s ambitions in the streaming market, pitting it head-to-head against industry giants like Netflix, Disney+, and HBO Max.

This acquisition represents a pivotal moment in the ever-evolving entertainment landscape. The streaming wars are far from over, and with Amazon’s bold move, the stakes have been raised higher than ever. The coming months will reveal whether this gamble pays off, and how it might redefine the way we consume entertainment.

New Amazon Fulfillment Centers: 10 New Centers in the U.S.

Which is the Top Streaming Service in 2022 Netflix, Amazon, or HBO?