What is ESG – Know it All

What is ESG – Know it All. In recent years, the concept of Environmental, Social, and Governance (ESG) has gained significant traction across various sectors, from finance to corporate governance. ESG represents a framework that assesses a company’s environmental impact, social responsibility, and ethical governance practices. This blog post explores the importance of Environmental, Social, and Governance and highlights how businesses can integrate sustainability into their operations to create long-term value.

What is ESG – Understanding ESG

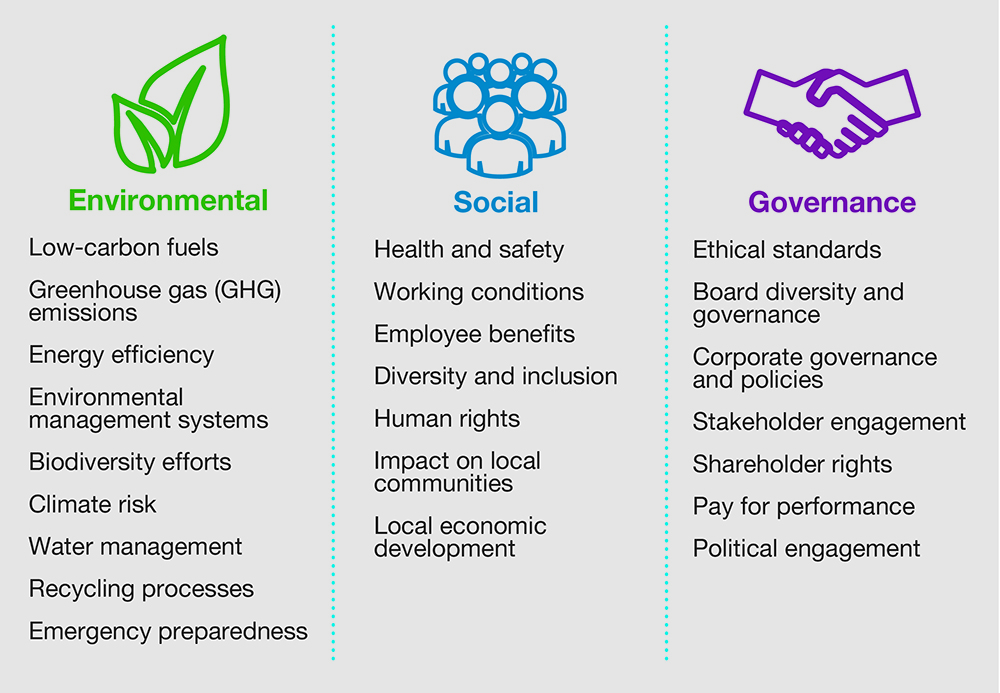

Environmental Factors

Addressing Climate Change: Climate change is one of the most pressing challenges of our time. ESG recognizes the importance of businesses taking action to reduce their carbon footprint, mitigate the effects of climate change, and transition to a low-carbon economy. This includes adopting sustainable practices such as investing in renewable energy sources, implementing energy-efficient technologies, and setting targets to reduce greenhouse gas emissions. By addressing climate change, companies contribute to global efforts to limit global warming and protect the planet for future generations.

Preserving Natural Resources: Environmental, Social, and Governance acknowledges the finite nature of natural resources and emphasizes the need to use them responsibly. This involves implementing sustainable resource management practices, reducing waste generation, and promoting circular economy principles. Companies can explore strategies such as recycling, resource efficiency, and responsible sourcing to minimize their impact on the environment and ensure the long-term availability of essential resources.

Social Factors

Promoting Diversity and Inclusion: Environmental, Social, and Governancerecognizes the value of diversity in all its forms, including gender, ethnicity, age, and socioeconomic background. Embracing diversity and inclusion within an organization fosters creativity, innovation, and better decision-making. By promoting diverse representation at all levels, companies can create a more inclusive workplace where everyone feels valued and empowered.

Ensuring Employee Welfare: Environmental, Social, and Governance places a strong emphasis on the well-being and fair treatment of employees. This involves providing safe working conditions, fair wages, access to healthcare, and opportunities for career development. Supporting work-life balance, mental health initiatives, and promoting a culture of respect and equality contribute to a motivated and engaged workforce.

Fostering Community Engagement: Environmental, Social, and Governance encourages businesses to actively engage with the communities in which they operate. This can include supporting local initiatives, investing in community development projects, and collaborating with stakeholders to address shared challenges. By building strong relationships with communities, companies can enhance their social license to operate and create positive social impacts.

Maintaining Strong Relationships with Stakeholders: Environmental, Social, and Governance recognizes that businesses operate within a broader ecosystem and have a responsibility to consider the interests of various stakeholders. This includes engaging with shareholders, customers, suppliers, and regulatory bodies in a transparent and collaborative manner. By actively involving stakeholders in decision-making processes, companies can build trust, manage risks effectively, and generate long-term value.

Governance Factors

Transparent and Ethical Business Practices: Good governance is at the core of ESG. Companies are expected to operate with integrity, transparency, and accountability. This involves implementing robust ethical policies, establishing clear codes of conduct, and promoting a strong corporate culture that values integrity and honesty. Transparent reporting on Environmental, Social, and Governance performance and adherence to relevant regulations and standards demonstrate a commitment to responsible business practices.

Effective Board Oversight: Environmental, Social, and Governance recognizes the crucial role of boards in providing oversight and strategic guidance. Boards are responsible for setting the company’s ESG strategy, monitoring its implementation, and ensuring accountability. Boards with diverse expertise and independence can effectively assess risks and opportunities associated with Environmental, Social, and Governance issues, align them with the company’s long-term goals, and drive sustainable performance.

Executive Compensation: Environmental, Social, and Governance encourages companies to align executive compensation with long-term sustainable goals. This can be done by linking executive pay to ESG performance metrics, such as carbon reduction targets or employee satisfaction scores. By incorporating Environmental, Social, and Governance factors into executive compensation, companies incentivize leadership to prioritize sustainability and social responsibility.

Risk Management: Environmental, Social, and Governance recognizes the importance of robust risk management practices. This includes identifying and assessing ESG-related risks, such as climate change impacts, regulatory changes, or reputational risks. By integrating Environmental, Social, and Governance considerations into risk management frameworks, companies can proactively identify and mitigate risks, ensuring resilience and long-term viability.

By understanding and addressing these environmental, social, and governance factors, companies can create a positive impact on society, build resilience, and position themselves for long-term success in a rapidly changing world. Environmental, Social, and Governance provides a comprehensive framework that encourages businesses to adopt sustainable practices, embrace diversity and inclusion, and operate with transparency and ethical governance.

What is ESG – Benefits of ESG Adoption

Enhanced Reputation

Companies with strong ESG performance have the opportunity to cultivate a positive brand image and enhance their reputation. Here’s how Environmental, Social, and Governance adoption contributes to reputation building:

Positive Brand Image: Embracing sustainability and social responsibility resonates with consumers who are increasingly conscious of the impact of their purchasing decisions. Companies that prioritize ESG factors can differentiate themselves by showcasing their commitment to environmental stewardship, social equity, and ethical governance. This resonates with consumers who prefer to support businesses aligned with their values, leading to increased brand loyalty and positive word-of-mouth recommendations.

Investor Attraction: ESG factors are gaining prominence in investment decision-making. Institutional investors, such as pension funds and asset managers, are incorporating Environmental, Social, and Governance considerations into their investment strategies. Companies with strong Environmental, Social, and Governance performance are more likely to attract investment capital as they are seen as having lower long-term risks and potential for sustainable growth. By aligning with ESG principles, companies can expand their investor base and access capital from funds specifically dedicated to sustainable investments.

Stakeholder Trust: Environmental, Social, and Governance practices build trust among stakeholders, including customers, employees, suppliers, and communities. Transparent reporting on ESG performance demonstrates a company’s commitment to accountability and responsible business practices. By effectively addressing environmental and social challenges, companies can enhance their relationships with stakeholders, creating a positive perception of the organization’s values and intentions.

Risk Mitigation

Integrating ESG factors into decision-making processes helps companies identify and mitigate potential risks. Here are some ways ESG adoption contributes to risk mitigation:

Regulatory Compliance: ESG factors are increasingly shaping regulatory frameworks globally. By proactively considering and aligning with ESG requirements, companies can reduce the risk of non-compliance and associated penalties. Understanding and addressing environmental and social risks early on can help companies adapt to changing regulations and avoid disruptions to their operations.

Reputational Damage: ESG issues, such as environmental accidents, labor controversies, or supply chain misconduct, can result in significant reputational damage. Integrating ESG considerations into decision-making processes allows companies to identify potential reputational risks and take appropriate measures to prevent or manage them. By acting responsibly and transparently, companies can mitigate the negative impacts of ESG-related incidents on their reputation.

Operational Disruptions: ESG factors can directly impact business operations. For example, climate change-related events, such as extreme weather or resource scarcity, can disrupt supply chains. By incorporating ESG risk assessments into business strategies, companies can identify vulnerabilities, diversify suppliers, and implement contingency plans to mitigate operational disruptions and maintain continuity.

Financial Performance

Companies with robust ESG practices often demonstrate better financial performance compared to their peers. Here’s how ESG adoption contributes to financial returns:

Cost Reduction: Sustainable practices, such as energy efficiency, waste reduction, and responsible resource management, can lead to significant cost savings over time. By optimizing resource usage and minimizing waste generation, companies can reduce operational expenses and enhance their bottom line.

Innovation and Market Opportunities: Embracing ESG considerations can drive innovation and unlock new market opportunities. For example, the transition to renewable energy sources presents avenues for growth and expansion. By proactively investing in sustainable technologies, companies can position themselves as leaders in emerging markets, gain a competitive advantage, and capture new revenue streams.

Access to Capital: Investors are increasingly integrating ESG criteria into their investment decisions. Companies with strong ESG performance are more likely to access capital from investors focused on sustainable investments. This access to capital can provide companies with additional resources to fund growth initiatives, research and development, and market expansion.

Long-Term Value Creation: ESG practices prioritize long-term value creation rather than short-term gains. By integrating ESG considerations into strategic planning, companies can identify and capitalize on sustainable growth opportunities, build resilient business models, and generate stable returns over the long run.

Numerous studies have demonstrated a positive correlation between strong ESG practices and financial performance. Research by Harvard Business School and other institutions consistently shows that companies with strong ESG performance tend to outperform their peers in terms of stock market returns, profitability, and resilience during economic downturns.

By embracing ESG adoption, companies can enhance their reputation, mitigate risks, and improve financial performance while contributing to a more sustainable and equitable future.

Unleashing the Power of ESG

What is ESG – Strategies, Transparency, and Overcoming Challenges

In the fast-paced world of business, Environmental, Social, and Governance (ESG) strategies have become indispensable for companies aspiring to thrive and make a positive impact. In this blog post, we provide a brief overview of implementing ESG strategies, the importance of reporting transparency, and overcoming the challenges that come with it. Stay tuned for our upcoming blog, where we dive deep into these topics, revealing powerful strategies for success. Don’t miss out – keep following!

Implementing ESG Strategies

ESG strategies are the key to unlocking sustainable growth and resilience. From board commitment to measurable goals and stakeholder engagement, these strategies drive transformative change. In our next blog, we will delve into the details, exploring how companies can infuse sustainability into their DNA, harness the power of stakeholder collaboration, and set SMART goals to drive ESG progress. Get ready to learn practical steps for implementing ESG strategies that can revolutionize your business.

Reporting Transparency

Transparent reporting is the bridge that connects companies with stakeholders, enabling them to showcase their ESG performance and foster trust. Our forthcoming blog will shed light on the importance of standardized reporting frameworks, such as the GRI, SASB, and TCFD, and how they help companies communicate their ESG efforts effectively. We’ll explore the art of clear communication, ensuring that your stakeholders understand the positive impact your business is making through ESG practices.

Overcoming Challenges

While the journey toward ESG excellence is rewarding, it comes with its share of challenges. In our next blog, we will uncover the hurdles that companies often face when adopting Environmental, Social, and Governance practices. From data collection and measurement to integration into existing systems, we’ll provide insights into overcoming these obstacles. Moreover, we’ll emphasize the significance of maintaining a long-term perspective, because sustainable change requires commitment and dedication.

Conclusion

ESG is a transformative force that can propel businesses toward a more sustainable and prosperous future. In our next blog, we will dive deep into implementing ESG strategies, reporting transparency, and overcoming challenges. Get ready to unlock powerful insights, practical tips, and game-changing strategies that will help you navigate the ESG landscape with confidence. Stay tuned and keep following to stay ahead of the curve. The journey toward ESG success begins now!

How to Develop an ESG Strategy

What is DAO? DAOs hit a new high $25 B