Porsche 911 GT3

Volkswagen will list Porsche in one of the largest IPOs in recent years. Porsche’s IPO may value the sports car manufacturer at $84 billion.

Volkswagen will list Porsche

Bloomberg predicts that the IPO will take place in the fourth quarter of 2022.

Volkswagen has already chosen its IPO underwriters, who include banking behemoths Goldman Sachs, Citigroup, JPMorgan Chase, and Bank of America. Given Porsche’s value as a German firm, it is expected that it will make its debut on the Frankfurt Stock Exchange.

It is too early to confirm the company’s share price, which will be published closer to the IPO date. According to Reuters, the parent firm expects to offer approximately 25% of Porsche AG stock in total.

Various analysts have estimated the automaker’s valuation to be about €90 billion ($102 billion). This is close to Volkswagen’s current market value of roughly €116 billion, and it outperforms other German automotive behemoths such as BMW (€51 billion) and Mercedes-Benz (€68 billion), both of which have been publicly traded for many years.

Following the first announcement of the IPO, shares in VW and Porsche SE increased by 10.2% and 15.2%, respectively, indicating that investors may expect Porsche’s brand value to rise in the long term, along with that of its parent firms.

Source: CMC Markets

Porsche – History

In 1931, Ferdinand Porsche (1875-1951) created the “Dr. Ing. h. c. F. Porsche GmbH” with Adolf Rosenberger and Anton Pich. The headquarters were located at Kronenstraße 24 in the heart of Stuttgart.

Initially, the company provided motor vehicle development and consulting services but did not manufacture cars under its own name. The German government gave the new firm one of its first assignments: to develop a car for the people, namely a Volkswagen.

This culminated in the Volkswagen Beetle, which went on to become one of the most successful car designs of all time. The Porsche 64 was created in 1939 using several components from the Volkswagen Beetle.

The Volkswagen factory was taken over by the British at the end of World War II in 1945. Ferdinand was arrested for war crimes and lost his position as chairman of Volkswagen’s board of management. Ferry Porsche, Ferdinand Porsche’s son, decided to develop his own car during his father’s 20-month imprisonment. He also had to guide the company through some of its most difficult days until his father’s release in August 1947. The first prototypes of the 356 were built in a tiny sawmill in Gmünd, Austria.

Porsche – Volkswagen

- The first Volkswagen Beetle was designed by Ferdinand Porsche

- In 1969 VW-Porsche 914 and 914-6 were produced. The 914-6 had a Porsche engine, and the 914 had a Volkswagen engine

- Porsche 924, used many Audi components and was built at Audi’s Neckarsulm factory

- The Cayenne shares its chassis with the Volkswagen Touareg and the Audi Q7

- Porsche SE and Volkswagen AG established an agreement in 2011 to integrate their automobile production activities to form an “Integrated Automotive Group.”

- Dr. Ing. h.c. F. Porsche AG as a 100% subsidiary of VW AG, is responsible for the actual production and manufacture of the Porsche automobile line.

How much is Porsche AG worth

According to some estimates, it might be worth up to $100 billion.

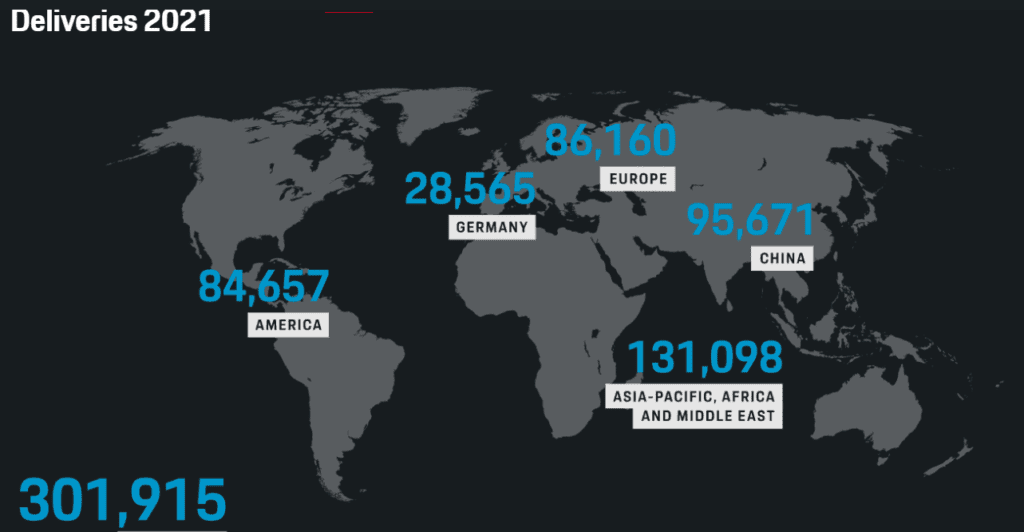

Despite accounting for only 3.5% of total deliveries, Porsche AG is one of Volkswagen’s most important brands, accounting for $5.5 billion of the company’s $21 billion operating profit in 2021. Porsche is also constantly successful, with an operational profit of $3.9 billion in 2019 and $4.2 billion in 2020.

Porsche has recently been quite successful, and it claims to have the highest profit per unit sold by any automobile company in the world.

Just a Trivia: There’s a compelling case to be made that Volkswagen’s brand portfolio would be better served as a separate organization. Aside from its own brand, the corporation manufactures automobiles ranging in price from Skoda to Audi, Ducati, Lamborghini, and Bentley.

More insights on the IPO

“This is a historic moment for Porsche,” VW and Porsche Chief Executive Officer Oliver Blume said. “We believe that an IPO would open a new chapter with greater independence for us as one of the world’s most successful sports-car manufacturers.”

With the share sale, the billionaire Porsche and Piech dynasty will reclaim direct control of what was once their family firm, 13 years after being forced to sell it to Volkswagen.

Investors will be able to acquire preferred shares in Porsche that do not have voting rights, while the family, which owns a 53% voting position in Volkswagen through its investment firm Porsche Automobil Holding, plans to buy a 25% plus one share blocking minority stake. Volkswagen will retain the remaining voting stock.

The manufacturer of the 911 sports car and the electric Taycan has acquired pre-orders valued between 60 and 85 billion euros. That outnumbers the shares on offer.

Porsche has also sparked interest from billionaires such as Dietrich Mateschitz, the inventor of the energy drink company Red Bull, and LVMH Chairman Bernard Arnault.

Source: Fortune

Visit more trending News on this site: Saudi Wealth Fund’s £653 million Investment in Aston Martin GM to unseat Tesla in the sales of EVs

shop nowUp To $40 Off Sitewide With Code: Summer40!