AI Chatbot Tiger GBT New kid in the block

AI Chatbot Tiger GPT New kid in the block. Tiger Brokers, owned by Up Fintech Holdings, is currently testing a product called TigerGPT, which is designed to provide investors with up-to-date financial information. However, similar to ChatGPT, the company’s artificial intelligence is susceptible to factual inaccuracies. Therefore, Tiger Brokers is currently in discussions with regulators, including those in Hong Kong, to address any potential concerns.

Tiger Brokers, an online brokerage company, has developed a trading bot that uses generative AI technology, similar to OpenAI’s ChatGPT, to explore how intelligent machines can replace humans in bond and stock trading. According to Jacques Li, Head of Global Communications at the Xiaomi-backed brokerage, the company has been closely monitoring AI and industry advancements since November of last year. Currently, TigerGPT is only accessible to a limited number of users via an invite-only beta version. The AI chatbot, like other similar services, can respond to a wide range of prompts on various subjects. However, it specializes in financial information to offer timely data to assist Tiger’s online trading platform users in making investment decisions.

AI Chatbot Tiger GBT uses GPT-3 model

Tiger Brokers, an online brokerage company owned by Up Fintech Holdings, considered providing its own AI to address pain points of its 2 million account holders and 9 million users for three months before launching TigerGPT this month. The goal of TigerGPT is to provide timely financial information to help users save time on market research and get up-to-date information. The chatbot was trained on a vast amount of premium content that Tiger Brokers has access to, enabling it to analyse current affairs and macroeconomic trends, such as the number of times the US Federal Reserve has raised interest rates this year. TigerGPT uses OpenAI’s Generative Pre-Trained Transformer (GPT) models, specifically the older GPT-3 model, unlike ChatGPT which uses GPT-3.5 and GPT-4.

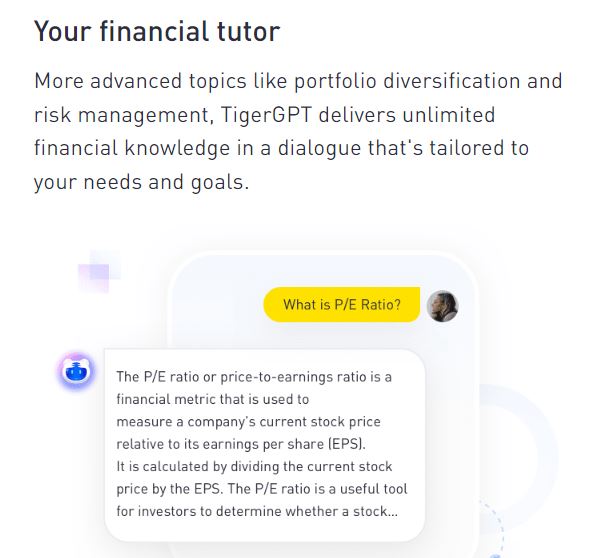

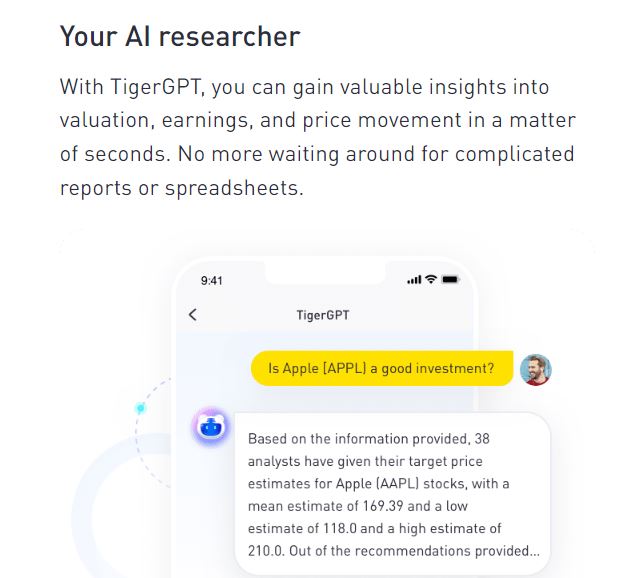

TigerGPT, an AI-powered chatbot developed by Tiger Brokers, can provide users with various types of information about companies in their portfolio, currently available in English or Mandarin Chinese only. The chatbot can offer company fundamentals based on earnings reports and third-party analysis, enabling users to compare company performance through a quick prompt. For instance, users can ask TigerGPT to pull up Tesla’s price-to-earnings ratio and compare it with those of other electric vehicle brands. This saves users time and provides them with quick access to information that might otherwise require multiple searches and self-tabulated data.

According to Jacques Li, head of global communications at Tiger Brokers, investors often need quick access to financial information, especially during times when the market is moving rapidly. While other services can provide this information, Tiger Brokers believes that its TigerGPT can give users timely and relevant answers as to why certain events are occurring and how they may impact their investment strategy. However, like other generative AI services, such as Google’s Bard, TigerGPT has been known to provide inaccurate answers. Li acknowledged this issue, but said that the project’s team of 50 people is working to improve accuracy by fine-tuning the system daily and incorporating the latest market information.

Regulatory Compliance

Li Said “Tiger Brokers has been in communication with regulators globally, including in Hong Kong, to ensure compliance and address their concerns regarding AI technology. The company believes that AI, along with other technologies, should be subject to strict regulations. In the next version of TigerGPT, the company plans to add an audio feature to allow users to ask questions and receive responses via voice commands. When OpenAI introduced ChatGPT last year, other tech companies were surprised by its immediate global success, prompting them to launch their own chatbots. However, the potential for unexpected and erroneous responses from LLMs like ChatGPT has limited their application in certain situations”

According to You Chuanman, the director of the Institute of Internal Auditors Centre for Regulation and Global Governance at the Chinese University of Hong Kong, Shenzhen Campus, the financial sector’s current use of robo-advisers and algorithmic investment indicates that the latest development of AI technology may not pose significant challenges to existing regulatory frameworks. You believes that the regulation of robo-advisers has been in place for the past ten years and that there is no fundamental change in the regulatory structure.

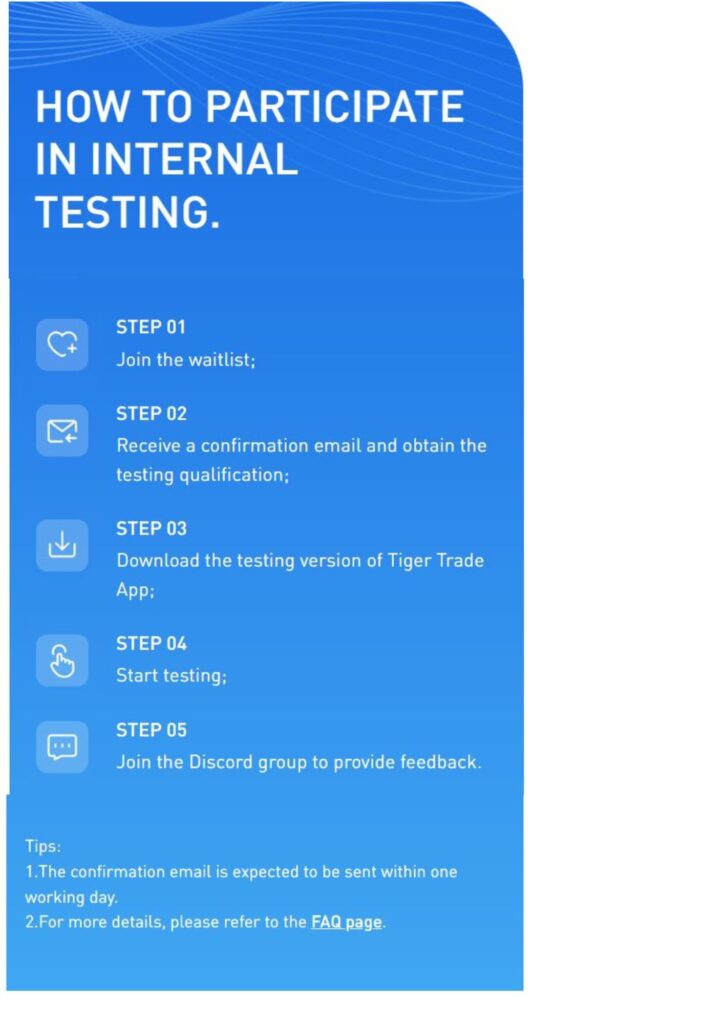

How to join AI Chatbot Tiger GPT

Source: SCMP

Pitfalls Of Image Generator AI And Deep Fake Technology