ICBC Bank Building China

Top 100 Banks in the World with enormous wealth. Despite a turbulent year for the global economy, American and Chinese banks once again dominate the 2022 Forbes Global 2000 list, which measures the world’s largest and most successful companies. Nearly half of the top 10 banks on the list are based in the United States or China

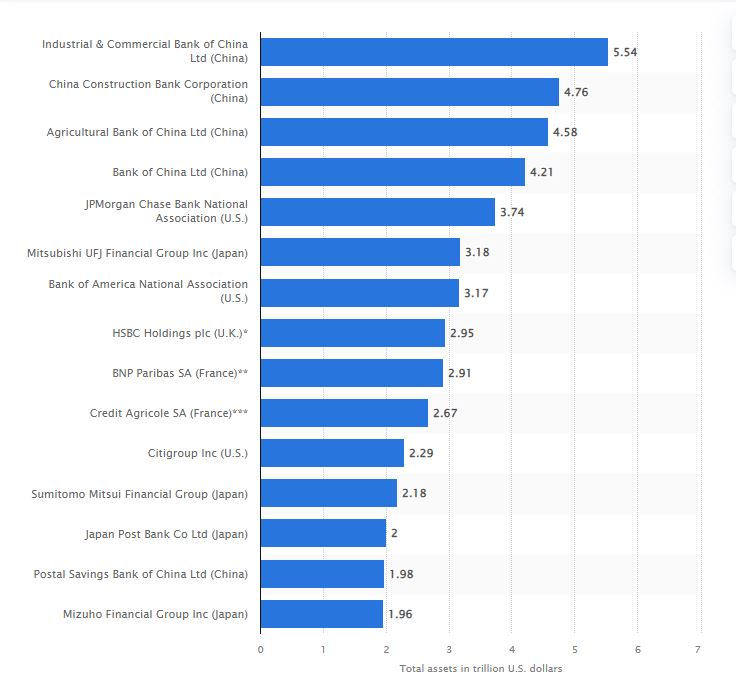

Industrial and Commercial Bank of China is once again the world’s largest bank, with assets of $5.5 trillion. Three other Chinese banks ranked in the top five. China Construction Bank ($4.7 trillion in assets), Agricultural Bank of China ($4.6 trillion), and Bank of China ($4.2 trillion).

JPMorgan Chase, the largest bank in the United States, moved from its second place last year to become the fourth-largest listed bank in the world with nearly $4 trillion in assets. Bank of America is the 9th largest bank in the world with $3.2 trillion in assets, Citigroup ranks 27th with $2.4 trillion in assets, and Wells Fargo ranks 18th among other major US banks (assets over $1.9 trillion), Goldman Sachs ranked 37th ($1.6 trillion) and Morgan Stanley ranked 36th ($1.2 trillion).

Along with the US and China, France’s BNP Paribas ranked 39th on the Global 2000 list and was Europe’s largest bank with $3 trillion in assets. Other top 100 members include the UK’s HSBC at No. 38 (with assets of $2.9 trillion), Canada’s RBC at No. 46, and Toronto-Dominion Bank at No. 52 (with approximately $1.4 trillion in assets each). included. ). Mitsubishi Financial Group, Japan’s largest bank with over $3.1 trillion in assets, ranked 59th on the list.

The 2022 Global 2000 list includes a total of 292 banks, up from 289 last year. Source: Forbes

Top Bank in the World with enormous wealth – Industrial and Commercial Bank of China (ICBC)

ICBC was established in 1984 and within a short span has grown to be the largest Bank in the World. The history of ICBC is on its official website.

“After the Third Plenary Session of the 11th Central Committee of the Communist Party of China was held in December 1978, the financial system reform in China started to speed up. As various financial institutions were re-established and the demand for financial services was diversified, in order to address the contradiction of the People’s Bank of China (“PBC”) for both serving as the monetary policy maker & financial regulator and getting engaged in specific business operation, in September 1983, the State Council officially decided that the PBC would only play the role as the central bank and a new Industrial and Commercial Bank of China would be established to undertake the industrial and commercial credit and savings business previously handled by the PBC. After intensive preparation, on January 1, 1984, the Industrial and Commercial Bank of China (ICBC) was officially incorporated, symbolizing the final setup of the national specialized bank system in China“

Top 100 Banks in the World – Top 15 graph by Statista

Top 100 Banks in the World with enormous wealth listed by S&P

S&P Global’s Insight into the Top100 Banks

The following is the Market intelligence report provided by S&P Global on the Top 100 Banks

European banks lost some of their dominance in the 2021 global wealth rankings, but China’s major lenders maintained their lead as the world’s largest financial institutions.

Twenty-six of his 37 European lenders on the list of the 100 largest banks in the world fell by one to nine notches year-over-year by the end of 2021, according to S&P Global Market Intelligence. Total assets of all European banks on the list fell by 2.16% to $36.890 trillion in 2021, down from $37.707 trillion a year earlier.

Some European lenders have shrunk their balance sheets after cutting state operations to compete with big US lenders. For example, Spain’s Banco Bilbao Vizcaya Argentaria SA dropped one place to number 47 after selling a US company with 639 branches and about $103 billion in total assets. However, HSBC Holdings PLC maintained its position and asset size by focusing on its wealth management business in Asia, offsetting the impact of the sale of its retail banking businesses in the US and France.

The resurgence of COVID-19 infection in several parts of the world and the impact of the conflict between Russia and Ukraine are expected to weigh heavily on the global economy this year. Growth was already expected to slow after 2021 when production recovered from the pandemic in most countries. Both of these factors are expected to complicate the normalization of monetary policy, as global central banks have become more cautious not to impede the recovery by tightening too soon amid high inflation.

Visit more Trending news on this site: Surging Iced Coffee Market is US$ 1.2 billion in 2021

https://go.nordvpn.net/aff_c?offer_id=658&aff_id=77497 (Click this link for Nord VPN)

Very much worth writing…..

Thank you so much