shanghai stock exchange building

Shanghai Stock Exchange – World’s Leading IPO Venue in 2022. It has been helped by massive offerings from companies like China Mobile, which has outperformed Hong Kong, the NYSE, and Nasdaq so far this year.

New listings from significant mainland Chinese companies that were delisted in the United States have helped the exchange.

According to Deloitte, fundraising in Shanghai reached US$32.4 billion, which is a 49% increase from a year ago, when it ranked fourth behind Nasdaq, the New York Stock Exchange (NYSE), and Hong Kong. This was made possible by a total of 68 IPOs, including jumbo offerings by China Mobile, the largest mobile operator in the world by subscriber count, and CNOOC, the largest offshore driller in China.

The Shenzhen Stock Exchange and the Korea Stock Exchange came in second and third, respectively, raising $15.5 billion and $15.4 billion.

The NYSE, Nasdaq, and Hong Kong exchanges came in at positions 7, 9, and 12, respectively.

Shanghai Stock Exchange-History

As per the Shanghai Stock Exchange website, “Shanghai in Mainland China’s first city to see the emergence of stocks, stock trading, and stock exchanges.

Stock trading started in Shanghai as early as the 1860s. In 1891, the Shanghai Share Brokers Association, an early form of the stock exchange, was established in Shanghai.

Later in the 1920s, with the founding of the Shanghai Securities Goods Exchange and the Shanghai Chinese Securities Exchange, Shanghai emerged as the financial center of the Far East, where both Chinese and foreign investors could trade stocks, bonds, and futures.

In 1946, the Shanghai Chinese Security Exchange was renamed the Shanghai Securities Exchange Co., Ltd. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Exchange.

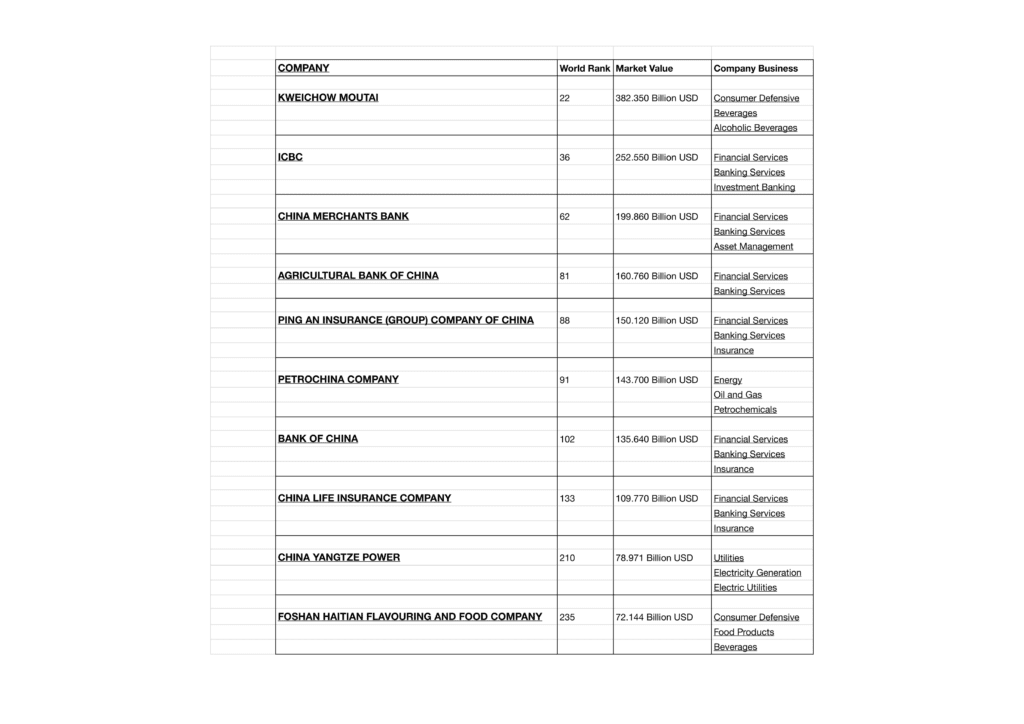

Top Companies Listed

Its success comes despite a two-month COVID-19-related closure that began in April, underscoring Beijing’s determination to keep the capital market open despite the worsening situation.

Structure of the Exchange

The securities listed at the SSE include the three main categories of Stocks, Bonds, and Funds. Bonds traded on SSE include treasury bonds (T-bond), corporate bonds, and convertible corporate bonds. The SSE T-bond market is the most active of its kind in China. There are two types of stocks being issued on the Shanghai Stock Exchange: “A” shares and “B” shares. A shares are priced in the local renminbi yuan currency, while B shares are quoted in U.S. Dollars.

Initially, trading in A shares are restricted to domestic investors only while B shares are available to both domestic (since 2001) and foreign investors. However, after reforms were implemented in December 2002, foreign investors are now allowed (with limitations) to trade in A shares under the Qualified Foreign Institutional Investor (QFII) program which was officially launched in 2003. Excerpt: Wikipedia

Other trending Articles on this site: Gambling in Thailand – Casinos to be legalized

shop now25% Off For V Part Wigs With Code: Graduation