eCommerce Logistics

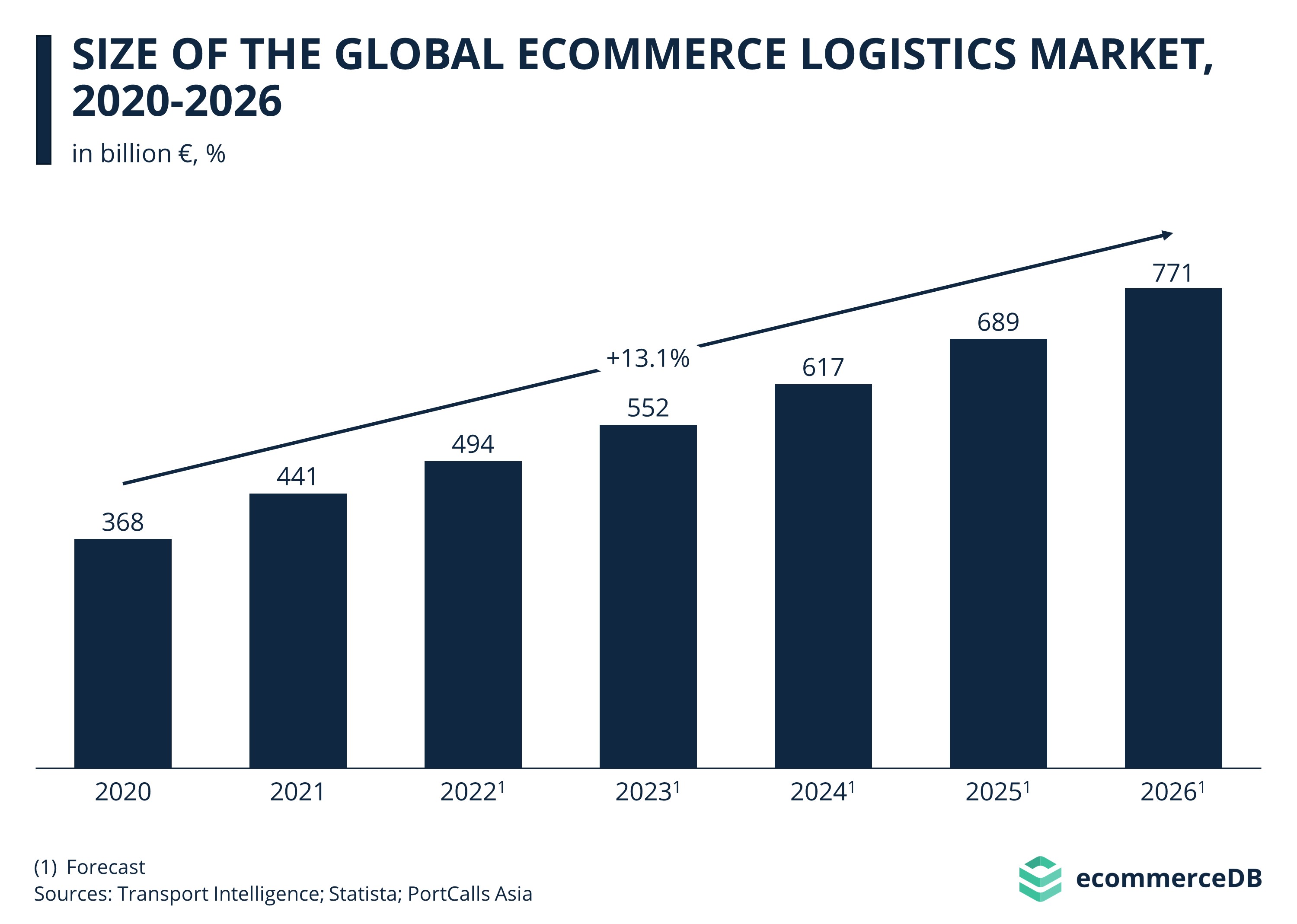

eCommerce logistics growth will double to US$771bn by 2026.

The shipping process is a crucial factor in the eCommerce customer journey, as it is a significant factor for customers who are shopping on-the-go on their mobile devices. The fast and hassle-free delivery process is highly valued by customers, and 66% of Germans consider direct home delivery as a good reason to buy products online, making it the most important eCommerce driver in Germany.

Other drivers such as cheap prices or the availability of online shopping 24/7 are less significant. Despite this, the frequency of online shopping and return rates are increasing. According to the Statista Global Consumer Survey from Q4 2022, the percentage of Germans who returned online orders in the past year has gradually increased from 47% in 2019 to 55% in 2022. Similar trends can be observed in other countries such as the United States, the UK, and China. As a result, global logistics face greater demands from eCommerce, which offers huge revenue potential.

Global eCommerce logistics Market

According to Transport Intelligence, the global revenue from eCommerce logistics reached US$441 billion in 2021. While this was slower growth than the previous year’s surge caused by the COVID-19 pandemic, the 20% increase in 2021 is still significant given the challenges of the global supply chain and the lifting of lockdowns. The global eCommerce logistics market is predicted to continue growing, with revenues expected to exceed US$500 billion by 2023, following a 13.1% CAGR. By 2026, the market is estimated to generate US$771 billion in revenue. The highly industrialized regions of Asia-Pacific, North America, and Europe drive the global market, accounting for over 95% of eCommerce logistics revenues. Currently, Asia-Pacific leads the market, but North America is catching up with a higher than average CAGR, and is expected to surpass Asia-Pacific by 2026 as the region generating the highest revenues from eCommerce logistics globally.

Source: ecommercedb

Grand View Research Report on eCommerce logistics

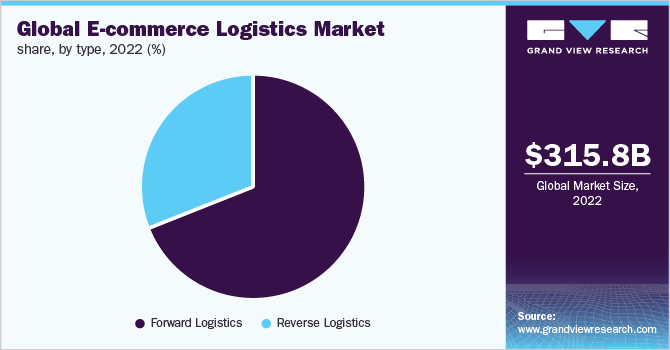

In 2022, the worldwide e-commerce logistics market was valued at USD 315.82 billion, and it is projected to experience a 22.3% compound annual growth rate (CAGR) from 2023 to 2030. E-commerce logistics encompasses a range of services, including warehousing, transportation, value-added services, and packaging services, and has seen rising demand due to the expansion of digital technologies. The growth of cross-border e-commerce and the increasing number of internet users, especially in developing nations, are the primary factors driving the growth of online business.

The use of e-commerce websites is becoming more popular among individuals for purchasing a wide range of items, from groceries and electronics to personal care products, furniture, and clothing, replacing the need to visit physical stores. The market is expected to expand significantly in the foreseeable future due to the increasing penetration of smartphones, the emergence of drone delivery, digitalization, and digital payments. Hardware technologies such as the Internet of Things (IoT), barcode technologies, portable data terminals, GIS, and GPS are further driving the growth of the industry.

There is immense potential for the expansion of the e-commerce logistics market, and venture capitalists (VCs) worldwide are investing heavily in e-commerce logistics startups to realize this potential. For instance, in January 2021, Lalamove, an Asian startup, received USD 1.5 billion, while the Indonesian company J&T Express received USD 2.5 billion in VC funding. The on-demand delivery sector has seen a significant influx of funds, compared to other categories, due to the growing demand for quick delivery among consumers.

Insights into Types of Services

The target market is categorized into transportation, warehousing, and other services based on service type. The transportation segment is further divided into airways, railways, roadways, and waterways. Warehousing is subdivided into mega centers, hubs/delivery centers, and returns processing centers. Mega centers are large fulfillment centers with ample storage space for goods. Goods are then transported from these mega centers to smaller hubs/delivery centers, which are increasingly important for enabling quick commerce. Among warehousing types, mega centers accounted for the largest market share of over 42% globally in 2022, while hubs/delivery centers are expected to be the fastest-growing segment with a CAGR of 21.8% during the forecast period.

In the service type segment, transportation constituted the largest share of over 70% in 2022, with the roadways segment having the highest market share of over 52% due to its role in carrying out last-mile deliveries. The airways segment is projected to grow at the highest rate with a CAGR of 24.8% during the forecast period, largely driven by the increasing demand for same-day and next-day deliveries, for which airways are the preferred mode of transport.

Insights into Operations

To elaborate on the operational aspect, the global e-commerce logistics market is divided into two segments: domestic and international operations. In 2022, the domestic operations segment had the highest revenue share of around 74.39%. However, the international operations segment is expected to grow at a faster CAGR of 24.9% during the forecast period.

The demand for international e-commerce logistics is on the rise due to an increase in cross-border shipments. The availability of foreign brands through major e-commerce platforms like Amazon and Alibaba has significantly contributed to the growth of the international e-commerce logistics market. As per a report by DHL, cross-border shipments account for almost 15% of the total e-commerce retail shipments worldwide.

International brands are partnering with third-party logistics providers to expand their reach in developing nations such as India, Indonesia, and Thailand where there is a high demand for foreign products. Furthermore, the market share of cross-border shipments is expected to increase in the coming years.

The demand for domestic e-commerce logistics is also increasing rapidly due to consumers’ preference for same-day delivery instead of next-day or standard deliveries. This demand is primarily due to the rise of quick commerce for food, grocery, and medicine delivery. As a result, the need for local hubs and delivery centers is also growing rapidly.

Model insights

To put it in different words, “Model Insights” refers to the segmentation of the e-commerce logistics market based on the business model adopted by logistics service providers. This includes two main segments, namely, the first-party logistics (1PL) and third-party logistics (3PL) segments.

The 1PL segment involves the delivery of goods through in-house logistics services managed by e-commerce companies. On the other hand, the 3PL segment includes logistics service providers that offer services to e-commerce companies for the management and delivery of goods.

In 2022, the 3PL segment accounted for the largest market share of about 65.71%, and this trend is expected to continue during the forecast period. The growth of the 3PL segment can be attributed to the benefits offered by 3PL providers, such as scalability, flexibility, and cost-effectiveness.

Moreover, the rising demand for logistics services from the e-commerce sector, along with the increasing popularity of same-day delivery and next-day delivery options, is driving the growth of the 3PL segment. The 1PL segment, on the other hand, is expected to witness moderate growth due to the limited presence of e-commerce companies with in-house logistics capabilities.

Vertical Insights

In 2022, the apparel category had the highest revenue share of approximately 38.13%. Online fashion sales are booming due to the convenience of viewing options, return policies, and discounts offered. Electronic gadgets such as mobile phones, speakers, and headphones are also popular on e-commerce platforms like Amazon and Flipkart.

The consumer electronics vertical is rapidly growing in the e-commerce industry. The food and beverage category is expected to have the fastest CAGR of 25.1% during the forecast period. The surge in demand for online food delivery, including groceries, restaurant food, and packaged food, is driving this growth.

Healthcare is another emerging category in e-commerce, with a rising share of online sales channels in pharmaceutical delivery. Transporting pharmaceuticals is subject to several strict regulations, which vary from country to country.

Insight into Regions

Compared to other regions, Asia Pacific has become the dominant region in the e-commerce logistics industry, primarily due to the high penetration of smartphones and the internet, which has boosted the demand for e-commerce and logistics services. The emergence of new e-commerce players in the region has positively impacted the growth of the e-commerce logistics industry. Furthermore, China’s significant investment in infrastructure, including ports, railways, and highways, is supporting the growth of logistics services in the country. Japan’s e-commerce logistic sector is expanding rapidly due to the growing preference of Japanese consumers for home delivery.

In addition, the adoption of advanced technologies by small and medium-sized businesses, ongoing modernization of Asia Pacific countries, and efforts towards digital transformation have significantly contributed to the market growth. North America has the second-largest revenue share of around 25.86% in 2022, mainly due to the presence of e-commerce giants like Amazon, Walmart, and eBay. Amazon, with over 100 fulfillment centers and 300 delivery centers to tackle last-mile dispatches, captured nearly 38% of all e-commerce providers in the US and continues to be the leading e-commerce retailer. As the demand for e-commerce continues to grow, the demand for e-commerce logistics will also increase in the region.

Major Players in the eCommerce logistics Market

The e-commerce logistics market is characterized by fierce competition, with numerous companies vying for market share. This includes major players such as FedEx Corporation, DHL International GmbH, and Aramex International, among others. To maintain a competitive advantage, these companies are engaging in various strategic initiatives such as expansion, mergers, and acquisitions. One way e-commerce logistics companies are seeking to expedite the process of delivering goods is by establishing warehouses in different countries worldwide.

For example, CEVA Logistics expanded its presence in Southeast Asia by opening a new warehouse in Vietnam in February 2021. This expansion aims to support distribution and storage requirements for customers across several industries. In another instance, Naqel Express announced the opening of its new pharma and cold chain warehouse facilities in Jeddah, Saudi Arabia, in November 2020. This facility is tailored to meet the needs of healthcare, pharmaceutical, FMCG, and related industries.

Other notable players in the global e-commerce logistics market include

- XPO Logistics Plc.,

- United Parcel Service, Inc.,

- Gati Limited,

- Kenco Group, Inc.,

- Clipper Logistics Plc.,

- Agility Public Warehousing Company K.S.C.P., and

- CEVA Logistics.

Green Tea world market a Sizable US$26.16 Billion

The Top Digital Marketing Trends to Watch in 2023