Value in Search Advertising

Value in Search Advertising – US$296.70bn in the year 2023. According to forecasts, the Search Advertising sector will witness a surge in ad spending, reaching a value of US$296.70bn in 2023.

The annual growth rate is expected to be 10.05% from 2023 to 2027, resulting in a market volume projection of US$435.20bn by 2027. The United States is expected to be the country with the highest ad spending, generating US$133.50bn in 2023. By 2027, mobiles will contribute significantly to the total ad spending in the Search Advertising segment, with US$260.20bn estimated to come from mobiles. The average ad spending per internet user in this sector is expected to be US$55.65 in 2023.

Value in Search Advertising – Players in the Market

Initially, Pay-per-click (PPC) ads were the first type of search advertising method used. In 1998, Google’s founders, Larry Page and Sergey Brin, introduced an auction-based model of PPC, in which the highest bidders would secure the top spots in the search results, while lower bidders would be placed further down. This approach has now become the most commonly used method by marketers. Currently, there are six major search engines, four of which have an international reach: Google, Bing, Yahoo!, and DuckDuckGo. Yandex focuses on serving nations that speak Russian, while Baidu targets nations that speak Chinese. Among advertisers, Google is the most popular search engine due to its massive user base and an effective internal advertising network.

The growth in search advertising can be attributed to two main factors: the development of internet infrastructure and the decreasing prices of internet-enabled devices, such as personal computers and smartphones. Over the past decade, the internet infrastructure has undergone significant transformation, resulting in faster and more affordable internet connectivity. Additionally, the decreasing cost of internet-enabled devices has made them more accessible to a wider audience, leading to an increase in daily usage and subsequent growth in search advertising.

Prior to the COVID-19 pandemic, search advertising was showing steady and consistent growth. However, the pandemic has accelerated the adoption of digital technology, resulting in exponential growth in search advertising, particularly on marketplace platforms. Despite the tightening of data privacy regulations and the increased emphasis on privacy by search engine platforms, data collection is still being conducted in a more ethical and consent-based manner. As a result, it is expected that search advertising will continue to grow steadily across search engine and marketplace platforms in the coming years.

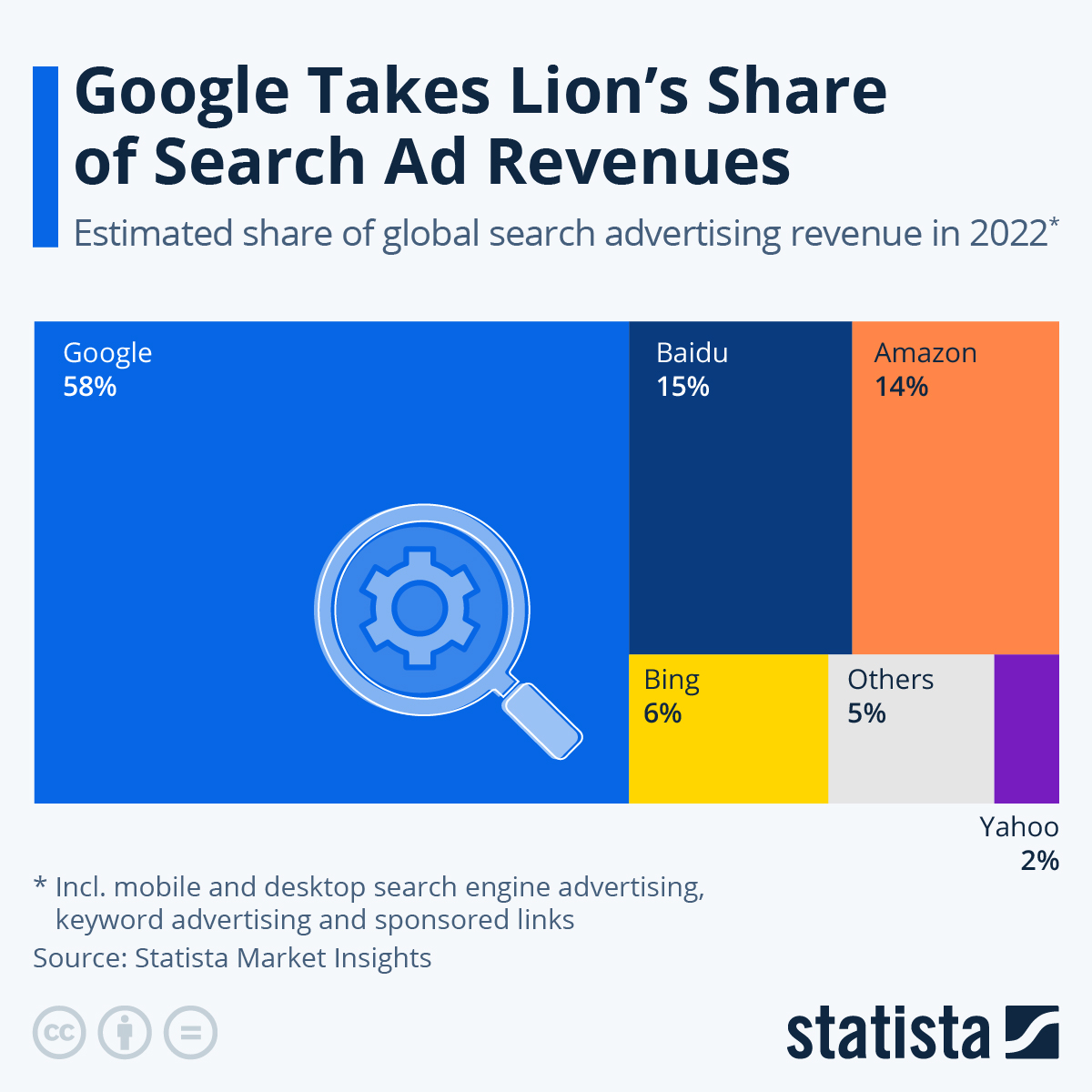

The majority of search advertising revenue is earned by Google

Google has been the dominant player in the search engine market for over 20 years, providing users with a gateway to the vast world of information on the internet. While there have been other alternatives like Lycos, AltaVista, Yahoo, Bing, and DuckDuckGo, none have been able to challenge Google’s near-monopoly position in the market. This has been a boon for Google and its parent company, Alphabet, generating over $160 billion in advertising revenue for Google Search alone in the last year. This revenue is a significant contributor to Alphabet’s trillion-dollar valuation.

According to Statista’s Digital Market Insights, Google has claimed nearly 60% of global search advertising revenues, amounting to over $150 billion in the previous year. Baidu, a Chinese search engine, ranked second with a 15% market share, followed by Amazon with 14%. Although Amazon is not typically seen as a search engine, it has been generating billions in advertising revenue from keyword advertising and paid search results on its own platform.

You will find more infographics at Statista

You will find more infographics at StatistaSource: Statista

The advertising division of Amazon experienced a 19% growth.

Amazon’s advertising business has continued to grow despite a general slowdown in digital advertising that has affected companies like Google parent Alphabet, Facebook parent Meta, and Snap. According to Amazon’s earnings report for the fourth quarter, the company’s advertising services unit generated $11.6 billion in sales, a year-over-year increase of 19%. Although Amazon’s advertising unit is still a small fraction of the $149.2 billion in revenue the company recorded in the same quarter, it is considered a fast-growing area that could become a key player in the digital advertising market.

Meanwhile, Meta executives do not expect an immediate rebound in the digital advertising market, which has been impacted by a weak economy and increased competition from TikTok. According to the latest Insider Intelligence survey, Amazon holds 7.3% of the overall online ad market, trailing behind Google, Facebook, and Instagram, which respectively hold 28.8%, 11.4%, and 9.1% of the digital ad market.

eCommerce logistics value will double to US$771bn

Namecheap is committed to offering the industry’s best value and customer service for domains, SSL certificates, hosting and more. Increase your sales while helping your clients build or improve their web presence. Join today and start earning. Click here to get your domain.

Are you looking for a trusted trading platform to buy bitcoin & other crypto currencies. Click Here.