BUIDL Token: Revolutionizing Digital Asset Markets

In the rapidly evolving world of digital assets, the BUIDL token is making waves. Launched by BlackRock, the world’s largest asset manager, the BUIDL token represents a significant step forward in the integration of traditional finance with the burgeoning crypto market. This blog post delves into the intricacies of the BUIDL token, its potential impact on the market, and the broader implications for digital asset trading.

What is the BUIDL Token?

The BUIDL token, officially known as the BlackRock USD Institutional Digital Liquidity Fund, is a tokenized money-market fund issued on the Ethereum blockchain1. Each BUIDL token is pegged to the US dollar, providing a stable and secure investment option for qualified investors. The token offers daily accrued dividends, which are deposited directly into investors’ digital wallets.

BlackRock’s Push into Digital Assets

BlackRock’s foray into the digital asset market is part of a broader strategy to leverage blockchain technology for greater transparency and efficiency in financial transactions. The BUIDL token is designed to provide institutional investors with a reliable and liquid investment vehicle, bridging the gap between traditional finance and the crypto world.

BUIDL Token as Collateral for Crypto Derivatives Trades

One of the most exciting developments surrounding the BUIDL token is its potential use as collateral for crypto derivatives trades. BlackRock, in partnership with Securitize, is in early talks with major global crypto exchanges, including Binance, OKX, and Deribit, to have it accepted as collateral. This move could significantly expand the market for BlackRock, positioning it as a key player in the crypto derivatives market.

The Role of Securitize

Securitize, a leading digital asset securities firm, plays a crucial role in the issuance and management of the BUIDL token. By providing a fully digital, regulatory-compliant platform, Securitize ensures that it meets the highest standards of security and transparency. This partnership underscores the growing collaboration between traditional financial institutions and innovative blockchain companies.

About Securitize

Securitize is a leading digital asset securities firm that was founded in 2017. Their mission is to unlock broader access to alternative investments by leveraging blockchain technology to digitize financial assets. They provide a fully digital, regulatory-compliant platform for issuing and trading digital asset securities, also known as security tokens.

Securitize aims to decrease friction and create liquidity in the private sector. They offer a comprehensive suite of solutions that enable companies to raise capital and provide individual investors with the opportunity to participate in private market digital asset securities. Their platform ensures compliance with regulatory standards, making it a trusted choice for both issuers and investors.

Recently, Securitize announced a $47 million strategic funding round led by BlackRock, highlighting their pioneering efforts in digitizing capital markets. This investment will fuel Securitize’s continued innovation and expansion, further solidifying their position as a leader in the digital asset securities ecosystem.

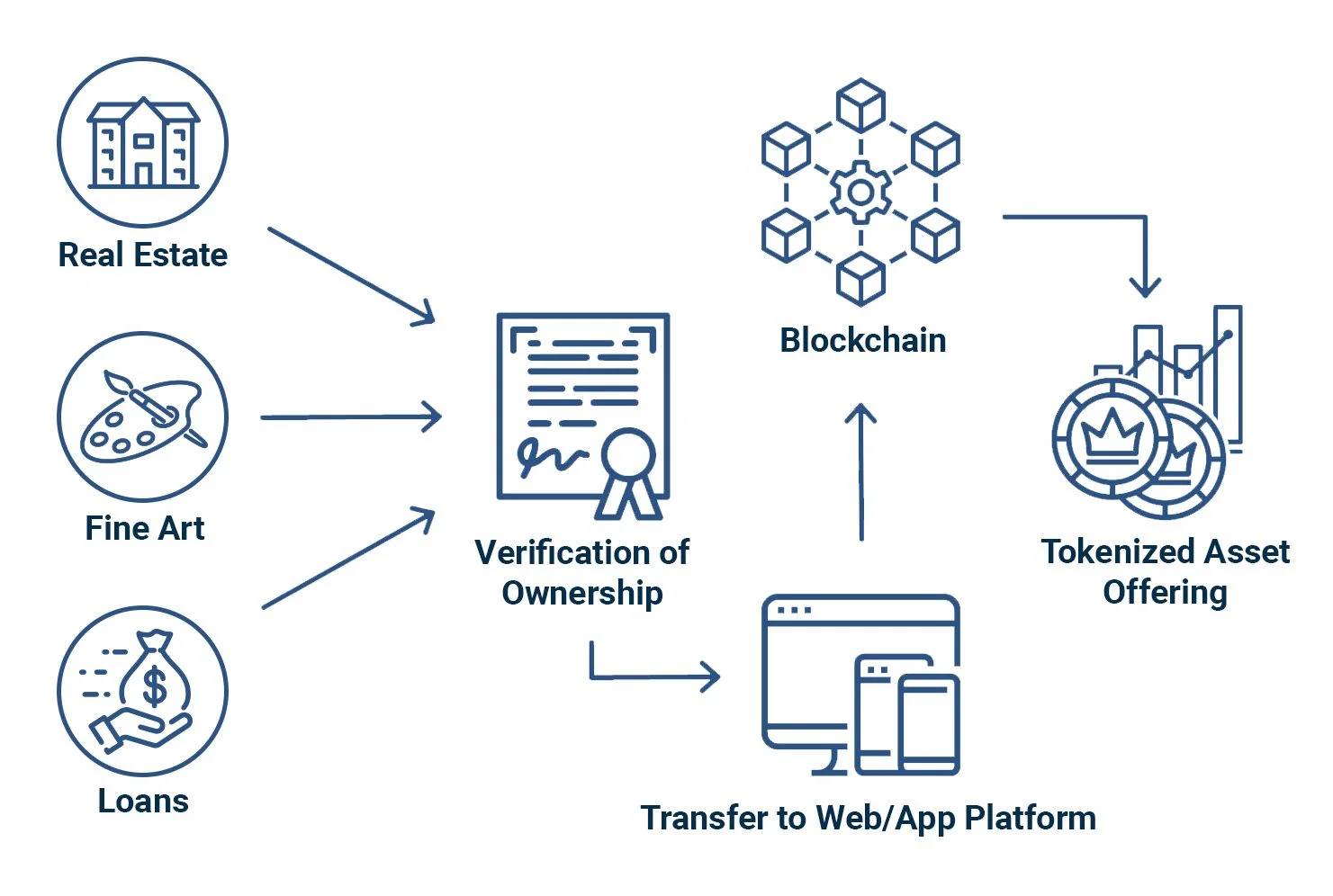

What Is Tokenization?

In simplest terms, tokenization is the process of issuing a digital representation of an asset on a blockchain. It involves converting the ownership of an asset—such as a piece of fine art, a commodity, or shares in a company—into a digital token stored on the blockchain. The token represents the asset and is used to track and transfer ownership of that asset.

Tokenization also provides access to entirely new financial markets, allowing assets that have historically been siloed in disconnected environments to exist in a common space.

Ultimately, tokenization aims to bring efficiency, liquidity, and accessibility to traditional, previously illiquid markets.

Implications for the Crypto Market

The acceptance of the BUIDL token as collateral on major crypto exchanges would mark a significant milestone in the integration of traditional finance with the digital asset market. It would provide institutional investors with a new level of confidence and security, potentially attracting more capital into the crypto space. Moreover, it would enhance the liquidity and stability of the crypto derivatives market, benefiting traders and investors alike.

Current Status of the Crypto Market

As of October 20, 2024, the global cryptocurrency market cap has increased by 0.9% to approximately $2.33 trillion. Leading the gains are major cryptocurrencies like Bitcoin, Dogecoin, Solana, and Shiba Inu. The volume of all stablecoins now stands at $70.39 billion, which is 90.86% of the total crypto market 24-hour volume.

The market is also witnessing significant activity with the upcoming Optimism (OP) airdrop, which plans to distribute 10 million OP tokens worth $16 million to selected wallets. Meanwhile, Polkadot (DOT) is experiencing a decline, with traders closely monitoring its critical price levels.

Additionally, the ongoing legal battle between Binance and the U.S. Securities and Exchange Commission (SEC) continues to be a major talking point3. The court has extended the lawsuit to 2026, allowing the SEC to amend its claims about Binance’s ICO, BNB sales, and staking program.

Overall, the crypto market remains dynamic and full of opportunities, with both bullish and bearish trends shaping the landscape.

Conclusion: BUIDL Token

The BUIDL token represents a groundbreaking development in the world of digital assets. By bridging the gap between traditional finance and the crypto market, it offers a stable and secure investment option for institutional investors. BlackRock’s push to have it accepted as collateral for crypto derivatives trades could revolutionize the market, paving the way for greater integration and collaboration between traditional and digital finance.

As the digital asset market continues to evolve, the BUIDL token stands out as a symbol of innovation and progress. Stay tuned for more updates on this exciting development and its impact on the future of finance.

Bitcoin ETFs: A Game Changer for Cryptocurrency Investing?

How many crypto millionaires are there in 2023?

Advantages of Cryptocurrencies – Full Research